$5.69

billion

New commercial mortgage lending amount in August 2023, according to the Australian Bureau of Statistics Lending Indicators data

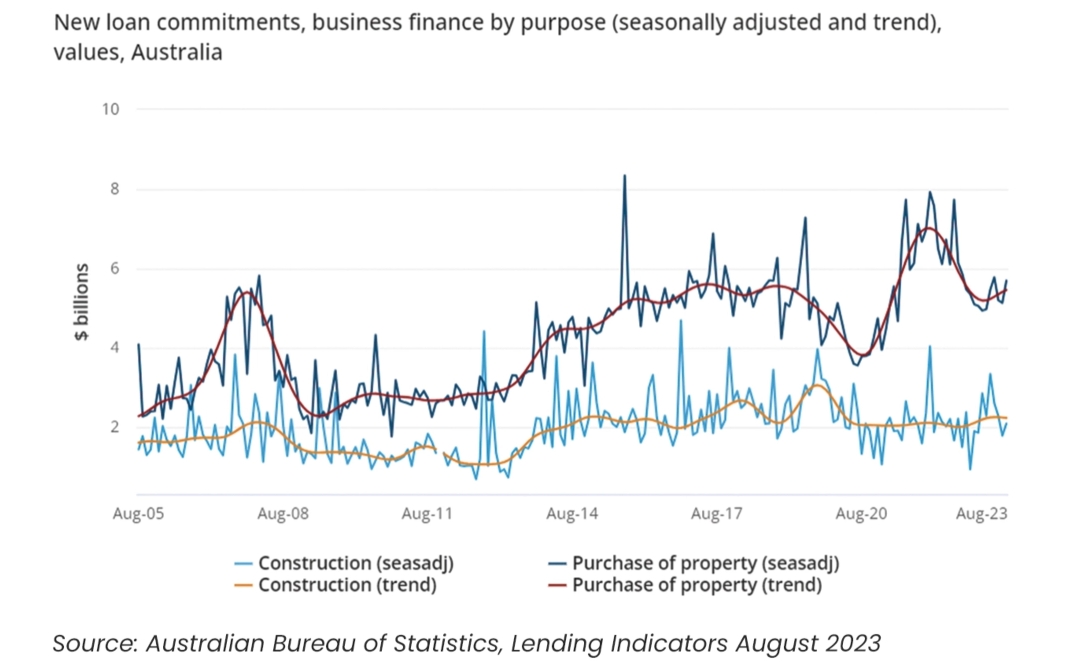

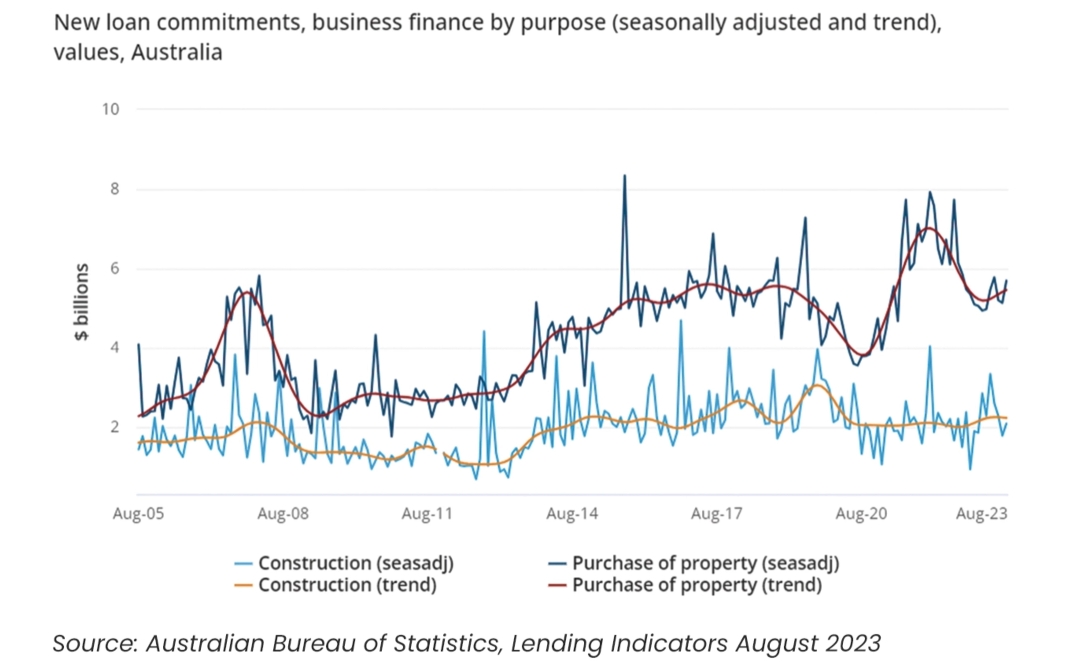

But despite the softening in commercial property over the past year as interest rates and property prices have risen, things are starting to look up again.

According to the Australian Bureau of Statistics Lending Indicators data, new loan commitments for business construction rose 17.2 per cent in August 2023 to $2.09 billion, while new commercial mortgage lending rose 10.8 per cent to $5.69 billion.

While both datasets are typically volatile due to the fact they are strongly affected by small numbers of high-value loans (for example, construction finance for commercial loans dropped 21.8 per cent in July 2023), they’ve both risen in trend terms (by 0.5 per cent and 0.8 per cent, respectively).

Another factor shaping the lending landscape for commercial mortgages is the fact that lenders have become increasingly flexible in offering loan terms to commercial borrowers. While traditional loan terms typically ranged between 15 and 25 years, some lenders now offer extended terms of up to 30 years. This shift allows borrowers to better manage their cash flows and improve the feasibility of their commercial projects. Furthermore, the growing popularity of private lending has also opened up new avenues for commercial borrowers – offering borrowers an alternative to traditional lending channels and, in most cases, a more flexible credit policy.

But the market is still nervous about some areas of the economy and lenders have become more selective in terms of the types of properties they finance. Sectors such as retail, hospitality, and construction have been particularly hard-hit by the rising cost of living and lending to these sectors has gotten much harder.

$5.69

billion

New commercial mortgage lending amount in August 2023, according to the Australian Bureau of Statistics Lending Indicators data

On the other hand, logistics, warehousing, and healthcare are all still seeing more favourable lending terms as these industries boom.

Moves are also being made to make commercial property investment more attractive, with the Victorian government recently unveiling a plan to remove stamp duty for commercial and industrial properties. From 1 July 2024, there will be an option of making a one-time upfront payment to cover the property’s final stamp duty amount or transitioning immediately to an annual payment structure. This proposed plan aims to provide relief to businesses and investors by reducing upfront costs associated with stamp duty.