JANUARY 2024

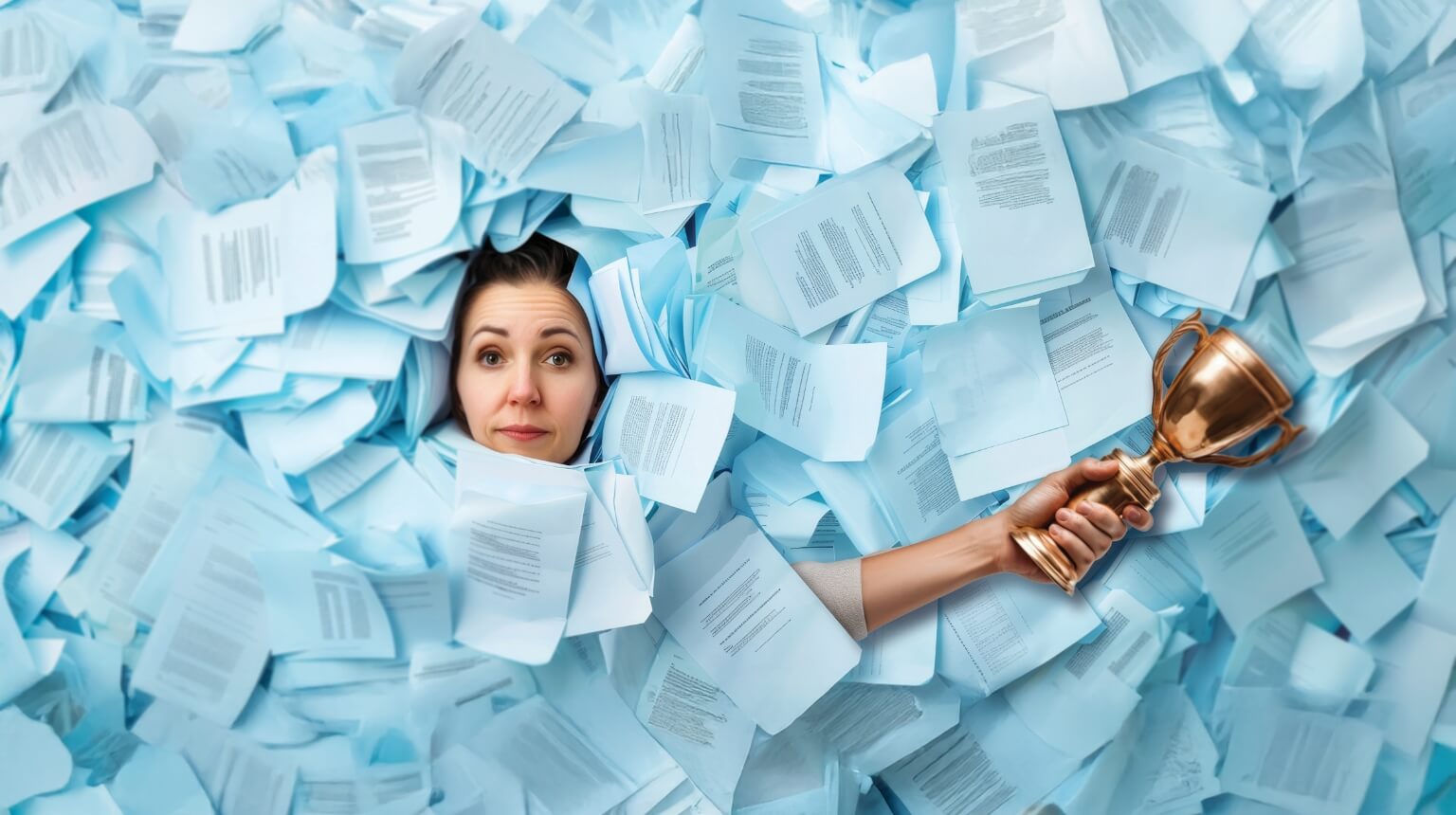

Finsure contests payroll tax ruling

Finsure Group (Finsure) launched action in the NSW Supreme Court against Revenue NSW regarding the application of payroll tax for some brokers. The aggregator confirmed it would be taking court action against Revenue NSW’s decision to retrospectively apply a payroll tax on mortgage and finance broker commissions.