Size of the market

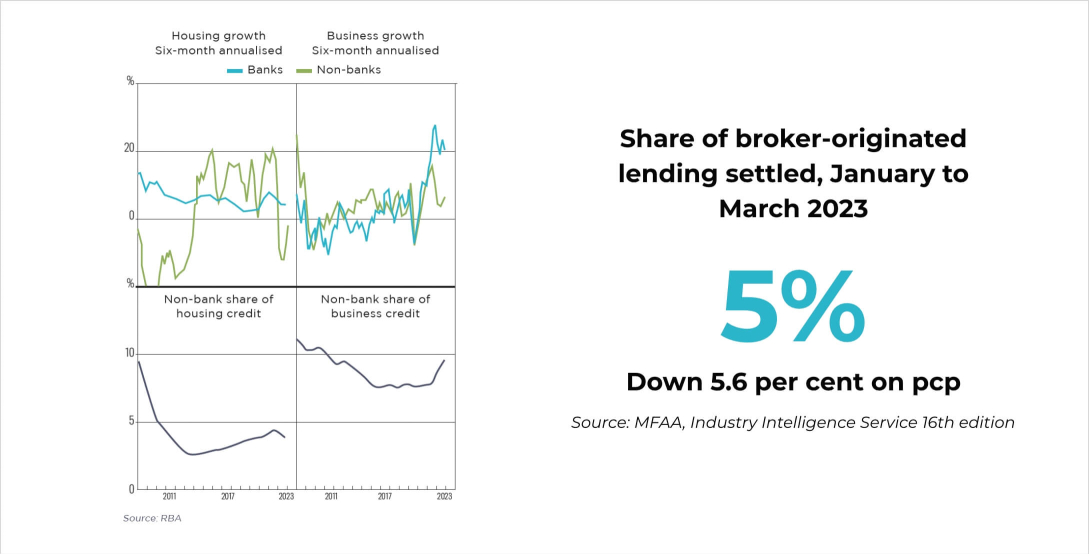

While there is no definitive source for the size of the non-bank sector, the Reserve Bank of Australia’s (RBA) April 2024 Bulletin estimates that non-bank lenders still account for a modest share of the nation’s financial system. According to the RBA, heightened competition from large banks weighed on the growth in non-bank housing credit during this period.

Housing and business credit

Share and volume from brokers

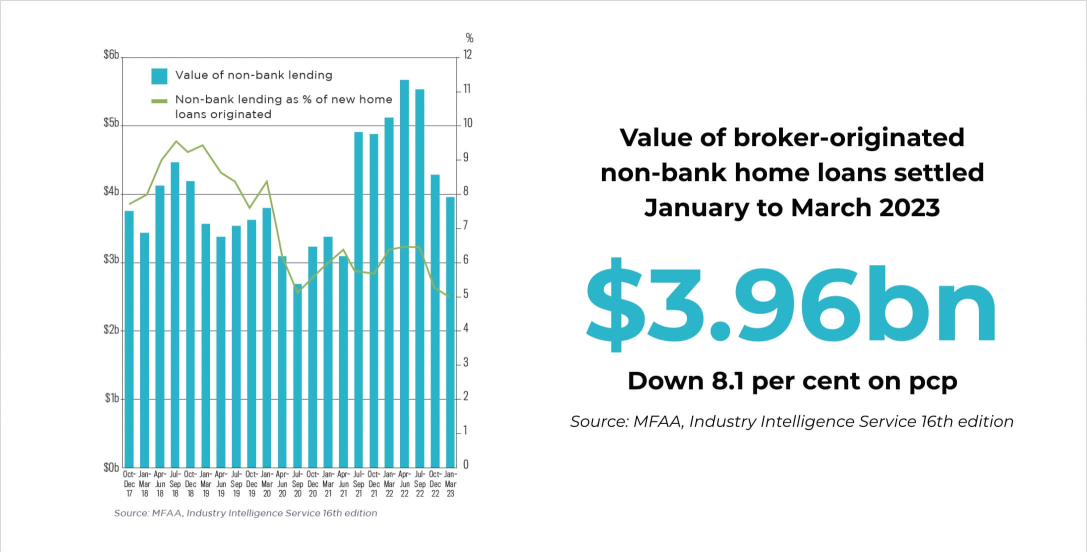

According to the Mortgage & Finance Association of Australia’s lastest Industry Intelligence Service (IIS) release, the value of broker-originated business for the non-bank lending segment declined in the March 2023 quarter to $3.96 billion, marking the second consecutive quarter with a decline in value. Despite this, the value remained 16.79 per cent higher than the value posted during the March 2021 quarter ($3.39 billion).

Value ($) and market share of broker-originated business to non-bank lenders