A word from Assetline

As we reflect on 2024, it’s no secret that brokers showed incredible resilience and strength in supporting their customers. Coming off the back of 12 rate rises since May 2022, brokers were faced with a complex landscape including higher demand paired with limited supply.

Against this backdrop, borrowers’ demand for creative and responsive financing solutions has continued at pace. Assetline is proud to champion the brokerages that have facilitated these changing borrower needs and is delighted to support The Adviser’s Top 25 Brokerages ranking.

Since 2012, Assetline has been committed to supporting brokers and their customers. This dedication is reflected in our ongoing developments within the business, building out our short- and long-term product offerings, enhancing our technology abilities, and expanding our footprint with sales teams across the country.

On behalf of Assetline, I would like to extend my congratulations to the top brokerages for their outstanding achievements and wish them all the very best for a successful year ahead.

Mortgage and finance brokers have been the channel of choice for Australian home buyers for the past decade, but by the end of the last financial year, nearly three-quarters (73.7 per cent) of Australian home buyers were choosing to use brokers to access mortgages, according to data from the Mortgage & Finance Association of Australia (MFAA).

The growth in the broker market share comes following several years of booming mortgage growth. The years immediately following the pandemic first saw home buyers enter the market in record numbers, quickly followed by a wave of existing borrowers turning to brokers to refinance their home loans in droves.

While FY24 may have been unremarkable in terms of cash rate movements (with just one change to the cash rate over the last financial year), brokers were still writing eye-watering volumes of mortgages. This came as more borrowers sought help understanding their options when accessing home loans in a tighter servicing environment.

In the final quarter of the financial year, for example, brokers settled a whopping $100.1 billion – a new record and the first time brokers have settled more than $100 billion in a three-month period (according to the MFAA).

But which brokerages are leading the way and why? In this year’s Top 25 Brokerages ranking, partnered by Assetline, it’s clear that the most successful broking businesses are able to service a large volume of customers efficiently and effectively.

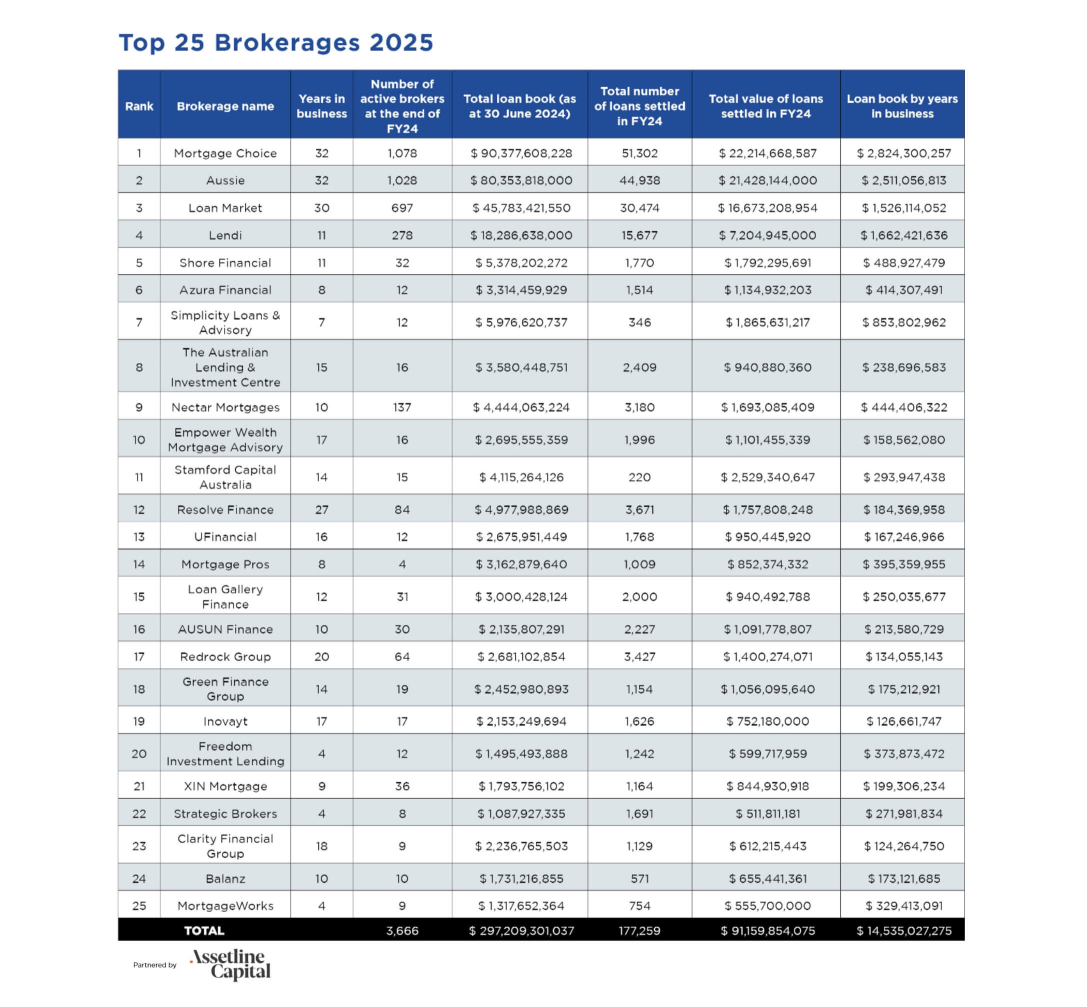

Indeed, a total of $91.1 billion was written by the Top 25 Brokerages over the year ending 30 June 2024 (FY24), spread across 177,259 loans. While this was $1.4 billion down on the $92.5 billion written by the Top 25 Brokerages in FY23, it’s a remarkable achievement given affordability and serviceability constraints and a heightened cash rate environment.

At the top of the 2025 ranking was Mortgage Choice, a major franchise that continues to grow its presence and had more brokers writing more volume than any other brokerage in Australia. Its 1,078 active brokers facilitated 51,302 loans in FY24, settling a total of $22.2 billion in loans in FY24. Mortgage Choice’s total loan book grew to $90.37 billion, solidifying its position as a leading player in the industry.

Aussie dropped from its top spot to rank second this year, with its 1,028 brokers settling 44,938 loans worth $21.4 billion. The brokerage grew its loan book to $80.35 billion, showcasing its consistent performance and strong market share.

Loan Market secured third place, with 697 brokers settling 30,474 loans worth $16.7 billion. Its strong performance was complemented by its growing broker numbers and total loan book, which reached $45.8 billion by the end of FY24.

Other noteworthy performers included Lendi, the highest-ranked non-franchise brokerage; Shore Financial, which demonstrated impressive growth as its 32 brokers settled 1,770 loans totalling $1.79 billion; and Mortgage Pros, whose four brokers managed to write an unbelievable $852 million across 1,009 loans in FY24.

With rate cuts expected to manifest in the coming months, the role of mortgage brokers will be more critical than ever in helping borrowers navigate the changing mortgage market.

How the Top 25 Brokerages ranking is compiled

The Adviser’s Top 25 Brokerages ranking is determined based on submissions from Australia’s largest brokerages.In each submission, brokerages are asked to provide a range of performance metrics including loan book size, number, and value of loans written within the financial year and a host of other measures to determine their size and scale. Each of these submissions is independently verified by Agile Market Intelligence with supporting documents and communications with each brokerage.

The ranking is calculated based on the relative rank of six metrics including loan book, value of loans settled, number of loans settled, number of active brokers/loan writers, loan book by years in business, and broker efficiency (value of loans settled divided by number of brokers).

A brokerage’s final rank is determined based on the sum of these metric ranks, equally weighted, to determine Australia’s Top 25 Brokerages. These Top 25 Brokerages are then re-ranked based on these metrics to determine their final place within The Adviser’s Top 25 Brokerages.

*Figures from broking groups that operate multiple models only include figures from their branded brokers.