A word from Resimac

Named non-bank lender with the best investor products in The Adviser’s Non-Bank Product of Choice awards, Resimac takes a commercial approach to lending to investors, assessing their overall circumstances in line with their requirements and objectives.

The non-bank lender’s full documentation and alt documentation loans offer competitive rates available for purchases and refinances, utilising a 2 per cent servicing buffer as well as assessing investor loans using 90 per cent rental income and negative gearing. In addition, Resimac investor products can have an offset account on each loan split.

Resimac’s experienced BDMs continue to support brokers to assist their investment customers and grow their businesses in a competitive financial market.

Property investment boomed during the first years of the 2020s, amid record-low interest rates. Then, as any mortgage holder is now only too well aware, interest rates shot up. Unsurprisingly, as the cost of servicing a loan increased, investment levels dipped.

Fast forward to now though and the investor market is back with a bang. In fact, many indicators suggest Australia’s investors now possess a far more positive outlook.

In May 2024, for example, the value of new borrower-accepted loan commitments for investor housing was 29.5 per cent higher than in May 2023, according to the most recent Lending Indicators release from the Australian Bureau of Statistics (ABS). Indeed, investor loan volumes rose to reach $10.9 billion in April 2024, the highest monthly value for nearly two years (since May 2022) and were hovering at $10.7 billion in May. This is not far-off owner-occupier volumes, which were $12.9 billion in May.

Fiona Cotsell, ABS head of finance statistics, says: “The value of new home loan commitments has still risen 18 per cent over the past 12 months. Loans to investors have continued to see stronger growth than owner-occupiers over this period.”

The average size of an investor loan for purchasing an existing dwelling has been growing, coming in at $625,739 in May 2024; 4.5 per cent higher than the average size of an investor loan reported in May 2023 ($598,405).

All these signs seem to indicate Australia’s investors are back and ready to do business.

Speaking to The Adviser, Resimac’s general manager of distribution Chris Paterson says that around 40 per cent of the lender’s settlements over the last six months have been for investment purposes, driven by strong demand from brokers.

He says the non-bank lender expects this steady volume to continue.

“Property investors continue to be active. However, due to increased interest rates and living expenses cash flow is important to customers,” Paterson says.

“There are some good opportunities across Australia for those investors that are patient.”

Investors seizing the moment

Part of what’s driving this investor resurgence is the sense that the economy has shifted – albeit quite cautiously – to a phase that offers property investors a chance at stronger returns.

In April, for example, the median weekly rent value for Australian dwellings rose 2.8 per cent to a record $627, according to CoreLogic data, an 8.5 per cent increase from last year.

Perth led the way with a 13.6 per cent annual bump to the median weekly rent value, followed by Melbourne (9.6 per cent), Adelaide (9.1 per cent), and Sydney (9 per cent).

But it’s not just the expectations of higher rental yields that have investors flooding back to market to access finance, it’s also partly down to serviceability. As the ABS’ head of finance statistics Dr Mish Tan says in June, investors typically have greater borrowing capacity – meaning that more people may be looking to purchase an investment property if they’re unable to access finance for owner-occupied needs.

Investors may have also been buoyed by the Reserve Bank of Australia’s (RBA) ongoing campaign against inflation reaching a period of stabilisation in recent months.

While interest rates remain elevated, the cash rate only went up 0.25 bps in the financial year 2024, with the solitary hike coming in November 2023.

This perception that interest rates were at the top of a cycle may have encouraged investors to re-enter the market (although persistent inflation in recent months has caused many economists to push out their forecasts for rate cuts and even start talking about a potential rate hike).

“While there may be interest rate and living expense increases there are good product options available to support cash flow and investor needs,” Paterson says.

“As we enter the new financial year, those customers will be ready to start or continue to grow their investments and take advantage of opportunities.”

What states are seeing strong investor activity?

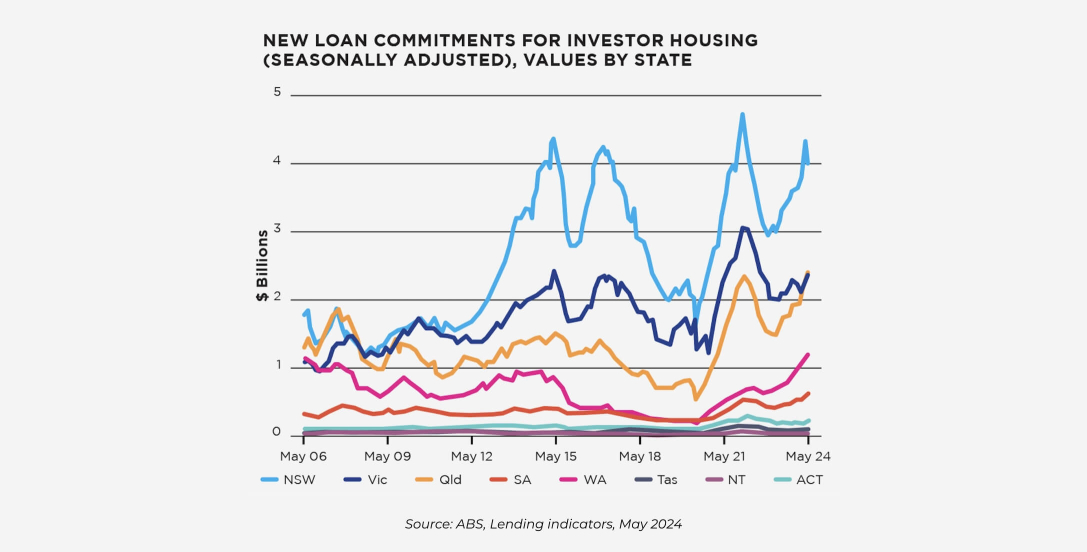

Over the month of May, the value of new loan commitments for investor housing grew in most states, with increases measured in Queensland (4.3 per cent), Victoria (3.4 per cent), Western Australia (5.3 per cent), South Australia (3.1 per cent), and the ACT (10.9 per cent).

Interestingly, May saw the value of new loans to investors in Queensland exceed Victoria for the third consecutive month, reaching a record high of $2.4 billion.

“This is mainly due to investors taking out larger loans in the Sunshine State compared to this time last year,” Cotsell says.

“We saw the average loan size for investors in Queensland increase by 14.3 per cent since May 2023, from $508,000 to $580,000.

“Comparatively, the average loan size in Victoria fell 3.2 per cent over the same period, from $584,000 to $566,000.”

Despite this, NSW remained the state with the highest value of new loan commitments for investor housing at $3.9 billion, according to ABS data.

While the value fell 9 per cent in NSW month on month, it was still 7.6 per cent higher than the value of new loan commitments for investors for the state in May 2023.

A complicated forecast

With the RBA consistently saying it isn’t ruling out rate hikes or cuts at the moment, investors’ eyes will remain firmly focused on what the Consumer Price Index is doing. But other regulatory changes continue to muddy the waters of any FY25 forecast.

Housing supply remains a state and federal issue and government initiatives to stimulate the housing market may also impact investor activity.

For instance, the national cabinet’s ambitious plan to build 1.2 million new and well-located homes in the next five years as part of the National Housing Accord could flood the market with new opportunities for investors with capital.

And in Victoria, while land-tax levies raised some costs for mum-and-dad investors, the introduction of commercial and industrial property tax (CIPT) reforms is expected to make things easier for would-be investors by turning stamp duty for commercial and industrial properties into an annual property tax.

“Brokers can help their clients navigate investment lending products by keeping up to date with all recent government changes including tax cuts, as well as staying abreast of lender’s policies and servicing requirements,” Paterson says.

The broker opportunity

Brokers recently voted Resimac as the non-bank with the best investor products in The Adviser’s Non-Bank Product of Choice ranking 2024 and Paterson says Resimac is listening to what the market needs and adjusting to demand. He flags the lender’s recent decision to lower its serviceability buffer to 2 per cent as an example.

“Repayments and affordability are key, so we recognised that if we can help reduce investor repayments by offering owner-occupier rates, that would certainly be something that could provide brokers with an additional incentive and opportunity,” Paterson says.

“It’s important that brokers have broad consideration of the customer’s requirements and objectives and look at the full picture: income received from their employment, income received from their rental property and other investment opportunities, to come up with an overall solution for the customer.

“By working with a lender that knows the investor market well, brokers will be well placed to ensure their clients are well looked after now and into the future.”