Over 350 members of the mortgage industry joined together to celebrate all aspects of the third-party lending market in Australia for the Mortgage Business Awards 2024, run with support from principal partner Resimac.

Held at Sofitel on Collins in Melbourne on 16 May, industry members gathered to cheer their colleagues and network with industry leaders.

At the evening event, a total of 22 leading lights from Australia’s booming residential third-party distribution channel (which now writes a record 74.1 per cent of all new residential home loans) were declared winners of the Mortgage Business Awards 2024, from a pool of 129 finalists.

Australian comedian (and member of The Chaser) Julian Morrow provided entertainment and laughter throughout the evening in his role as emcee.

Winners spanned aggregators, brokerages and brokers, lenders, loan administrators, marketing professionals, technology providers, and individuals and company innovators.

Individual awards

Mortgage brokers operating in metropolitan and regional Australia were championed at this year’s awards

Mortgage Choice Melbourne owner and partner Cameron Price was named Mortgage Broker of the Year – Metro, while the Mortgage Broker of the Year – Regional award was given to Picker Financial Solutions’ director Justin Picker.

The founder and managing director of new brokerage broker.com.au, Matthew Board, was crowned this year’s New Broker of the Year.

The Innovator of the Year – Broker award went to 10X Home Lending Group principal owner and mortgage broker Michael Wu. Judges were impressed with his well-structured submission that said why he would succeed in the long term.

Loan administrators and marketing professionals were also given the nod for consistently supporting brokers and helping them raise their game.

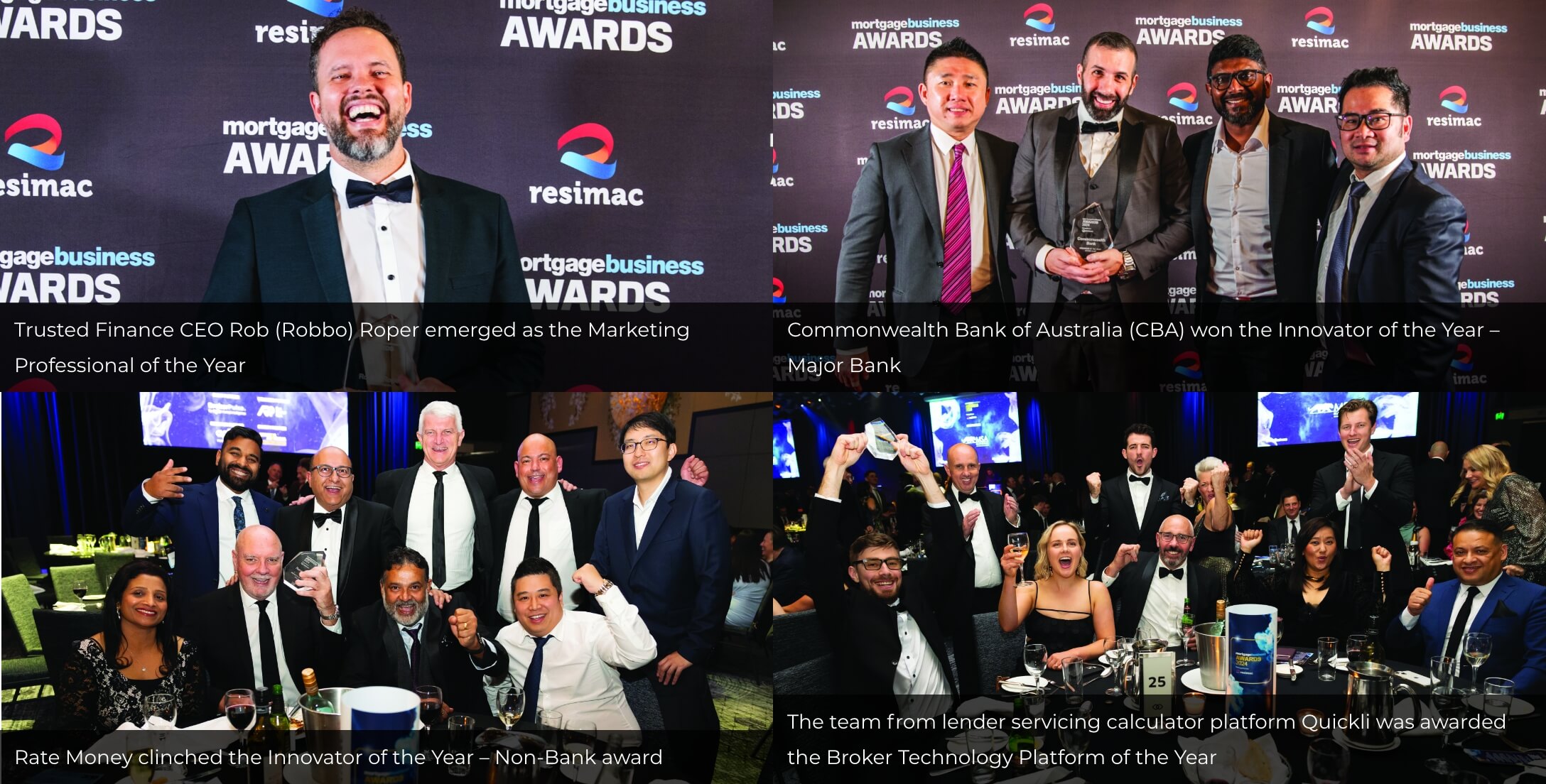

Arch Brokerage client manager Holly O’Loughlin won the Loan Administrator of the Year award, while Trusted Finance chief executive Rob (Robbo) Roper emerged as the Marketing Professional of the Year.