PLAN Australia has launched a new tool that aims to help brokers analyse their business and identify opportunities and solutions for improved business performance.

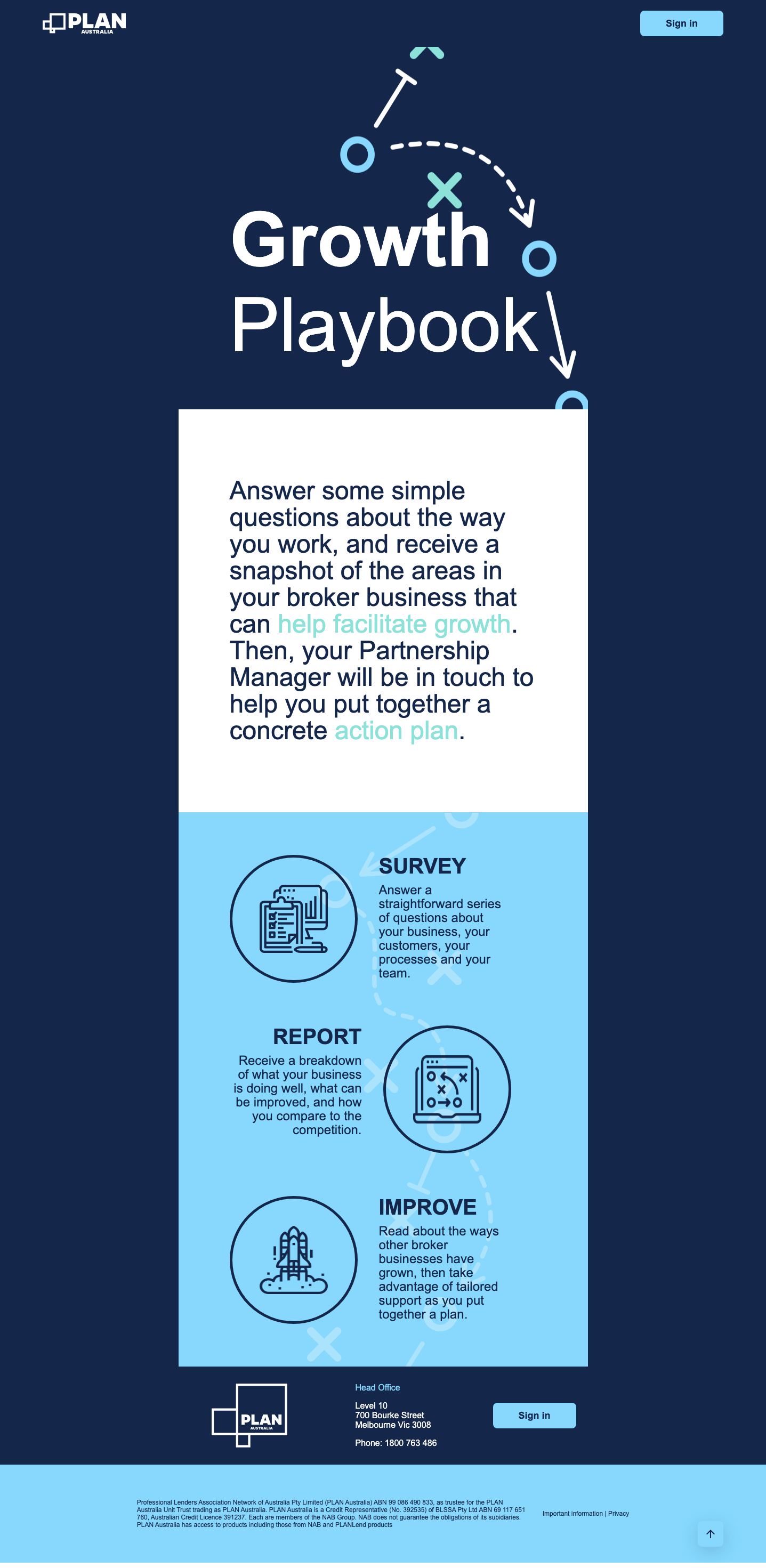

The aggregator has launched a new business optimisation service for brokers, called the PLAN Australia Growth Playbook.

The playbook, built in partnership with creative agency The Royals, comprises a diagnostic tool that helps brokers benchmark their business against other broker businesses in the PLAN Australia network, and provides a range of case studies and strategies that the broker can undertake to improve the efficiency of their brokerage.

The playbook, built in partnership with creative agency The Royals, comprises a diagnostic tool that helps brokers benchmark their business against other broker businesses in the PLAN Australia network, and provides a range of case studies and strategies that the broker can undertake to improve the efficiency of their brokerage.

While the PLAN Australia Growth Playbook will initially be made available to PLAN brokers for free, the aggregator said it has a view to offer the tool to all mortgage brokers at a later date.

Through the new offering, PLAN brokers are first asked to fill in a survey via the tool touching on four business areas:

- Business metrics (loans book size, profit margins, revenue composition etc)

- Customer acquisition and retention (lead generation strategies, customer communication strategies etc)

- Processes (loan writing process, outsourcing opportunities, business planning reviews etc)

- Teams (staff structure, key person risk, culture and business goals etc)

They are then given a report card with an overall score out of 100 (as a percentage), as well as a breakdown for each segment.

The broker is then provided with best practice case studies and “plays” from within the PLAN network, among other strategies to improve their score.

A report is also sent to a PLAN partnerships manager to help the broker workshop the business consultancy ideas with them.

According to the aggregator, the Growth Playbook isn’t intended to try and get every broker to a perfect 100 per cent score, but instead help them determine how their business is faring – and how it can be improved.

Moreover, the aggregator said the playbook also provides a consistent approach to partnership management and business consultancy advice across the network, too.

‘Designed to help broker businesses succeed in a sustainable way’

PLAN CEO Anja Pannek commented: “As the growth partner to our members, PLAN Australia plays a critical role in helping brokers unlock the potential within their businesses.

“The Growth Playbook is designed to help broker businesses succeed in a sustainable way.”

Ms Pannek noted that every broking business is unique and has its own strengths and weaknesses, but said the Growth Playbook “effectively takes an inventory of each business and identifies which areas brokers need to focus on with their partnership manager”.

Stephen Bourne, head of strategic partnerships and wealth at PLAN Australia, told The Adviser that the tool comes at a crucial time for the broking industry – as the sector ramps up to the incoming best interests duty on 1 January 2021.

“For brokers, a continual source of angst is the hours that they work and the time that they spend in office. And one of the goals that we know many brokers are looking to achieve is how to actually work less and how to gain efficiencies in the process as things become more complex. And we believe, as we move into 2021 and into the best interests [duty], that may continue to be a friction point…

“So, absolutely, we see the need [for this] is greater than it has been in the past, in my view.”

Mr Bourne continued: “When we have a look at what made a broker business successful from 2015 to 2020, the tweaks they’ve made and the work they’ve done, that might not make them successful in 2021 through to 2023.

“So, we talked to our brokers about what a successful broking business looks like in 2023? And what they can be doing today to set them up to get there.

“The tool actually uses the data from their business, the insights of what they’re trying to achieve, and puts it into a report that gives them places to specifically start and begin to probe deeper. And then have plays for our partnership managers to support them in that,” he said.

Ms Pannek concluded: “As a professional services provider to the mortgage broking industry, we continue to identify tools and strategies that can be leveraged to support premium broker businesses.

“We are committed to building a vibrant, competitive and customer-focused industry so that more Australians can achieve their dreams in partnership with an experienced mortgage broker,” Ms Pannek said.

“Providing brokers with the services and support they need to grow their business will ultimately drive significant benefits to customers.”

[Related: Why brokers should do a stocktake of their processes]