The aggregator’s in-house lending division has priced a $750 million residential mortgage-backed securities issue.

AFG Securities Pty Ltd – the lending arm of ASX-listed aggregator Australian Finance Group Ltd (AFG) – has priced its first residential mortgage-backed securities (RMBS) transaction of the year.

AFG’s wholly owned subsidiary upsized the RMBS transaction AFG 2023-1 from $500 million to $750 million following strong demand.

More than 25 investors took part in the transaction, which is expected to settle on 26 October 2023.

Speaking of the deal, AFG’s chief executive David Bailey commented: “We are very pleased to be able to not only price this transaction on very favourable terms but to be able to upsize the issue to meet market demand.

“AFG Securities’ product offering and lending standards are recognised as a sound investment opportunity, and we are delighted to see both return and new investors from across the market.”

According to AFG, the transaction received “competitive pricing” with most notes pricing “inside or on the left-hand side” of the initial pricing guidance, with “good coverage across all of the notes which allowed the transaction to upsize,” Mr Bailey said.

“AFG Securities’ provision of a competitive lending alternative provides choice for Australian home buyers and drives much-needed competition in the mortgage market,” he concluded.

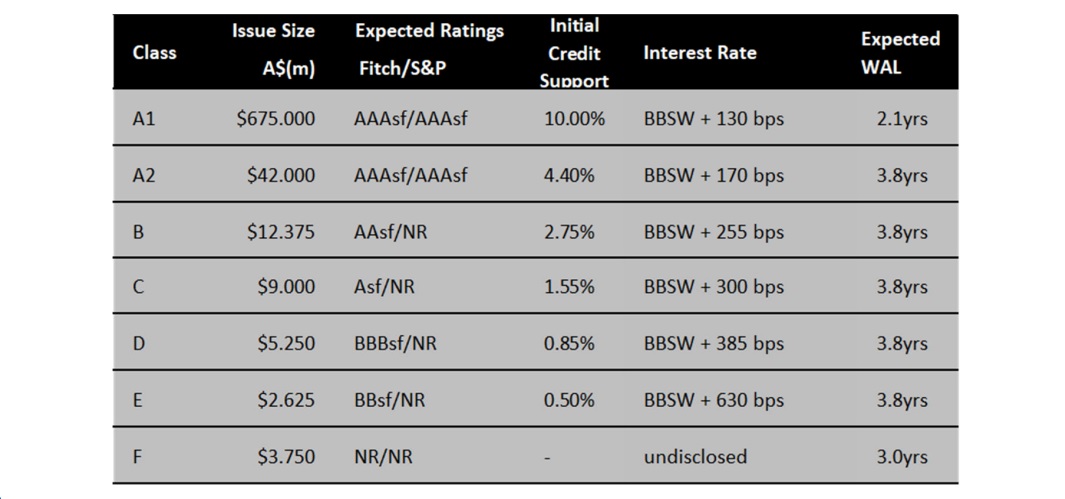

Details of the notes are as follows:

The most recent transaction means that AFG Securities has now issued more than $8 billion since 2013.

Last year, AFG Securities priced two RMBS transactions: a $750 million RMBS (AFG 2022-1) and a $1 billion RMBS issue (both of which were upsized).

The group has been a strong proponent of the RMBS market, with AFG chair Greg Medcraft having recently outlined that he believes a public RMBS system should be created in Australia to provide a level-playing field for mortgage lenders when it comes to funding, thereby introducing more competition in the home lending market.

The lender has been utilising the RMBS market to help fund its growth and last week launched an interest-only loan targeted at over 50-year-olds looking to refinance an existing investment debt with a loan term of up to 40 years.

AFG Home Loans Retro Thrive is available for refinances on a dollar-for-dollar basis, up to 65 per cent loan-to-value ratio (LVR), with borrowers only needing to pay back the interest each month.

The introduction of this product range adds to AFG’s existing products comprised of AFG Home Loans Retro and AFG Home Loans Link.

[Related: AFG Securities launches refinancing offering for mature-aged borrowers]