The south-west of Sydney has the highest home loan arrears of any capital city, according to new data from S&P Global Ratings.

Erin Kitson, the director of structured finance ratings at credit rating agency S&P Global Ratings, has revealed that while mortgage arrears are increasing in Australia, they’re still holding firm at long-term averages and are not increasing across all of Australia evenly.

Speaking to The Adviser’s In Focus podcast following S&P Global Ratings’ Australian Property Spotlight Seminar 2023 in Sydney on Tuesday (25 July), Ms Kitson outlined that S&P has tracked the Australian residential mortgage-backed security dataset and found that 30+ day mortgage arrears were hovering around the long-term averages of 1 per cent as at May 2023.

While Ms Kitson noted that the arrears rate had been rising recently as a result of “a very large run-up in interest rates”, she highlighted that this was “certainly lower” than the arrears peaks S&P had seen during the global financial crisis (GFC), when arrears were at 1.8 per cent.

The director of structured finance ratings commented that while there are increasing housing affordability pressures at the moment, as a result of the 400-bp increase in interest rates in the past 14 months and “stubborn” inflation, the unemployment rate has remained low.

Ms Kitson flagged that unemployment and the resulting loss of income was a “key cause of mortgage defaults” – but given Australia’s unemployment has remained at record-low levels of 3.5 per cent – this has been “a very important anchor in helping to keep mortgage arrears low”.

Other contributors to subdued arrears rate in this tightening cycle have been the savings buffers that were built during the pandemic and a competitive refinance market that has seen “borrowers self-manage their way out of arrears” by taking advantage of better mortgage rates, Ms Kitson said.

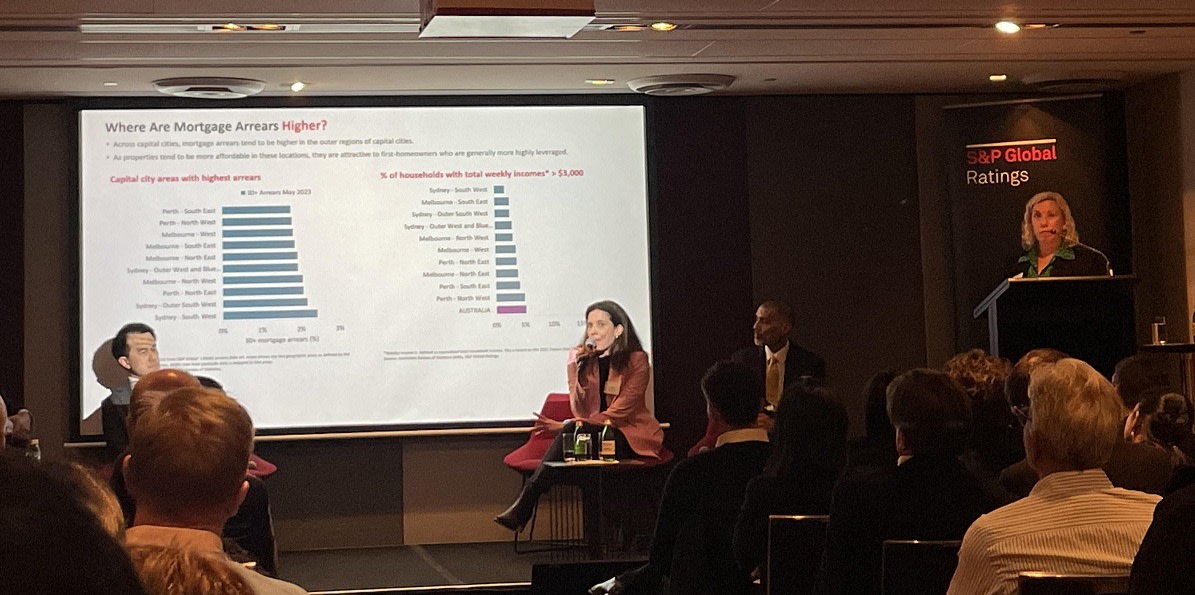

However, she noted that S&P had identified that particular geographic areas were seeing higher arrears levels than others.

According to the research, the outer regions of capital cities are generally the areas that are seeing higher arrears.

S&P has found that Sydney’s south-west region had the highest arrears of the capital cities in May – hovering over 2.2 per cent.

Perth’s north-east also saw 30+ day arrears around 2 per cent, as did Melbourne’s north-west and Sydney’s Outer West and Blue Mountains area.

But other outer ring areas of Melbourne and Perth also had arrears rates around the 2 per cent mark.

According to Ms Kitson, a large reason for this is that these areas tend to have more affordable properties, which are attractive to first home owners and lower-income earners, who are generally more highly leveraged.

She told the In Focus podcast: “If we look at arrears rates across our capital cities, the trend that starts to become apparent is that mortgage arrears are certainly higher on the outskirts and fringes of capital cities compared to inner-city areas.

“If you think about the types of borrowers and why that might be the case, housing is typically more affordable on the cusps on the fringes of capital cities. This is likely going to attract the types of borrowers like first home owners, for example, who – given their stage in life – are often more deposit constrained and therefore need to be more highly leveraged; they need to take on more debt.

“These types of borrowers are going to be more susceptible to high interest rate rises, given they may not have the saving buffers available to older borrowers.”

S&P flagged that while around 5 per cent of Australia’s population earns more than $3,000 a week (based on 2021 census data), this drops to less than 2 per cent of households in Sydney’s south-west – where arrears are highest.

Conversely, nearly 20 per cent of those in Sydney’s eastern suburbs (which have an arrears rate of around 0.7 per cent) earn more than $3,000 a week.

Indeed, mortgage arrears tend to be lower in areas close to the CBDs, where property prices are typically higher and where the proportion of households earning high weekly incomes is larger.

“Those higher income levels and areas where you’ve got borrowers on those high income levels, they’re (not surprisingly), probably not going to be experiencing the same level of debt serviceability pressure, as areas where those income bands and proportions are not as high,” she concluded.

You can find out more about Australian mortgage arrears and expectations for the Australian property market in The Adviser’s In Focus podcast.

Tune in to the episode with Erin Kitson, In Focus: How Australian mortgage arrears are tracking, below:

[Related: Snakes and the property ladder]