Persistently low consumer demand has led to a 42 per cent drop in the average value of B2B invoices year-on-year, according to new data.

The challenging operating environment will result in a “sharp rise” in the business failure rate in the 12 months, the credit reporting agency has warned.

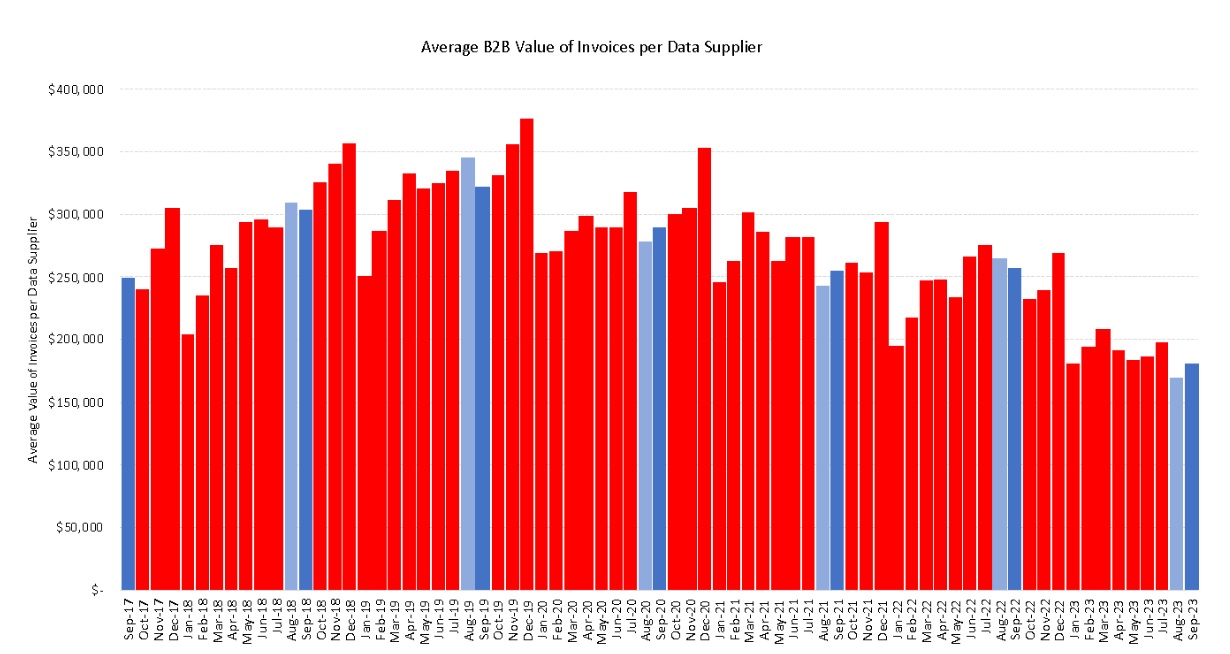

CreditorWatch, a credit reporting agency that manages the credit files of all commercial businesses in Australia, has found that while there was a minor lift in invoice value from August to September, the average value of business-to-business (B2B) invoices was down 42 per cent year-on-year well below pre-COVID-19 levels.

The average value of invoices is a critical metric on the health of Australian businesses, the agency has flagged, as it impacts companies along the supply chain in multiple industries.

According to the September 2023 CreditorWatch Business Risk Index (BRI), the value of invoices rose between August and September 2023 to hit around $180,000, but remains well below normal levels.

Indeed, in September 2022 and September 2021, the average value of invoices was over $250,000, while in September 2020 it was near the $300,000 mark.

Given the high inflationary environment, the body said it would expect the average value of invoices to be rising (given the increasing cost of goods and services), however, there has been a noticeable downward trend since late 2019.

Source: CreditorWatch Business Risk Index, September 2023

The agency said that there was no expectation that the trend would reverse shortly, due in large part to “persistently low consumer demand”, which it flagged was “somewhat concerning for the health of the economy”.

CreditorWatch’s other key business indicators such as trade payment defaults, credit enquiries and court actions also reflect that businesses are facing “challenging conditions”.

For example, B2B trade payment defaults (a key predictor of future business failures, according to the agency) continue to trend upward, with a 57 per cent year-on-year increase.

Moreover, the volume of credit enquiries undertaken by businesses on suppliers was up 58 per cent year on year.

The group has forecast that the national probability of business failure over the next 12 months (either through a liquidation event, ASIC strike-off of the company or deregistration) has risen to 5.76 per cent.

CreditorWatch concluded: “While Australia stands out among OECD countries as one of the better performers economically, the business operating environment will still be challenging for at least the next year.

“By mid 2024, we should have some reasons to believe that the cash rate will soon fall, and this will give many businesses (and consumers) more confidence to spend and invest.

“However, until then, large tax bills, rising insurance premiums, depressed consumer spending and high debt repayments are all issues that will be very confronting for some businesses and, in some cases, insurmountable.”

While the average value of invoice finance has been falling in the past year, more providers are looking to offer working capital solutions to Australian SMEs.

The Commonwealth Bank of Australia (CBA) recently announced that its venture-scaling arm, x15ventures, had entered an agreement to acquire cloud-based invoice lending platform Waddle from Xero.

CBA stated that the move would help more business customers unlock cash tied up in unpaid invoices by harnessing the digital cash flow solution.

CBA group executive business banking Mike Vacy-Lyle said at the time: “Access to working capital is vital for many businesses and Stream Working Capital offers greater flexibility, simplicity and faster access to cash flow.”

Moreover, non-bank lender Earlypay recently told The Adviser that inquiry levels for debtor finance were “incredibly high at the moment”, which Lee Trego, the lender’s national head of growth, said “shows that business owners are feeling the impacts of the economy”.

Speaking on The Adviser's In Focus podcast in August, Mr Trego said: “Businesses are taking action to explore their options, but they’re certainly in need of an adviser to navigate the unknowns and find the best solution...

“Brokers play a crucial role in guiding SMEs toward these finance options, especially considering that many SMEs lack awareness of available solutions,” he added.

You can find out more about the trends being seen in the invoice finance market, and how brokers can help support SMEs with debtor finance, in the In Focus podcast episode, sponsored by Earlypay, below:

[Related: Sharp rise in business failures expected: CreditorWatch]