The figures cited by the initial hearing of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry could be wrong, a broker has claimed, after finding a “major flaw” in the commission’s online form.

Speaking to The Adviser following a story that detailed that one in 10 royal commission submissions related to mortgage brokers, Queensland-based broker Nicki McDavitt indicated that the figures could be inaccurate due to an oversight in the online form used by the commission to gather data and case studies.

Ms McDavitt explained that her concerns arose after reading the figures cited by Ms Rowena Orr QC regarding the “nature of the dealings” involved in the submissions received thus far.

Ms Orr told the initial hearing earlier this week that more than 385 submissions had been received through the online form, with:

- 49 per cent of responses relating to banking;

- 18 per cent relating to superannuation;

- 6 per cent relating to general insurance; and

- 6 per cent relating to the life insurance and total permanent disability insurance market.

Looking at the “nature of the dealings” involved in the submissions received, Ms Orr stated that:

- 31 per cent related to personal finance;

- 17 per cent related to superannuation;

- 13 per cent related to small business finance;

- 12 per cent related to mortgage brokers; and

- 9 per cent related to financial advice.

Ms McDavitt told The Adviser that she was curious to find out what percentage of submissions related to home loans acquired through the bank branches/direct, as “there was no mention of [“nature of the dealings” relating to] bank branches. It showed these statistics but had nothing to show for branches and direct applications”.

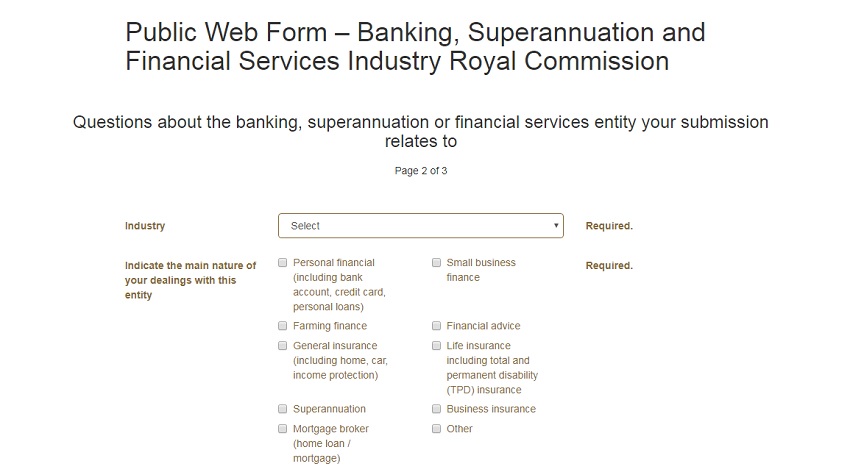

The broker therefore went to look at the online form and found that there was no option to select “bank branch” for home loan/mortgage (see below for reference).

Instead, the second page of the online form asks users to “indicate the main nature of [their] dealing with this entity”, choosing from:

- Personal finance (including bank account, credit card, personal loans)

- Farming finance

- General insurance (including home, car, income protection)

- Superanunation

- Mortgage broker (home loan/mortgage)

- Small business finance

- Financial advice

- Life insurance (including total and permanent disability [TPD] insurance)

- Business insurance

- Other

The statistics “don’t mean anything now because of this failure of the commission”

The broker and principal of McDavitt & Associates told The Adviser: “There is nothing for home loans from a branch or directly… [So], I’m absolutely sure that people providing submissions have therefore just been clicking the mortgage broker button just because it is the only one that specifies ‘home loan/mortgage’.

“I’m really concerned. We’ve had so much scrutiny over the last month and some really damaging headlines that are so far from the truth... but what do people do if their beef is with a home loan from a branch of a bank? If I’m having trouble finding where the correct category is, others must be, too.”

Ms McDavitt said that she believes that the 12 per cent figure about submissions relating to mortgage brokers is therefore incorrect, as the category may include submissions from people who are trying to report misconduct in relation to their home loan, regardless of channel.

She continued: “So, those statistics are false. They don’t mean anything now because of this failure of the commission.”

Ms McDavitt added that she therefore wishes to see the form amended online to include a section related to home loans at banks, as she does not believe that the “other” box is an option that many people will choose.

She concluded: “This is a Royal Commission into Misconduct in the Banking and Financial Industry and it’s too important. We really need to get this right. This is too important not to have this changed.”

Commission 'confident' that users are able to identify correctly the nature of their dealings

The Adviser contacted the royal commission and asked it why there is no option to choose “bank branch/direct” for a home loan; whether the online form will be amended to include an option of “bank branch (home loan/mortgage)”; and how many submissions were received for the “other” category.

A spokesperson for the commission commented: “The online submission process is working well and based on the number of submissions received to date, we are confident that those using the form have been able to identify correctly the nature of their dealings, including to identify home loans taken out with banks.

“We are also reviewing submissions as they come in to ensure that they are appropriately categorised.

“We are committed to ensuring that the information on our website is clear and easy to understand, so we will continue to review and improve the website going forward.”

[Related: 1 in 10 submissions to Royal Commission relate to brokers]