More than $69 billion of new residential loans at the banks were originated by the third-party channel in the December 2020 quarter, new APRA stats show.

The Australian Prudential Regulation Authority (APRA) has released its quarterly authorised deposit-taking institution (ADI) statistics for the quarter ending December 2020.

According to the Quarterly Authorised Deposit-taking Institution Property Exposures publication, the value of new loans funded by the banks in the final three months of the year 2020 totalled $127.3 billion, up 20 per cent on the prior comparative period (quarter ending December 2019).

Of this, $88.8 billion was for owner-occupied loans, up more than $17 billion on the same period in 2019 and $10 billion more than in the September quarter 2020.

Interestingly, the stats show that the value of third-party originated loans (loans where the ADI’s primary contact with the borrower at origination is through a mortgage broker or another party) rose markedly in the quarter.

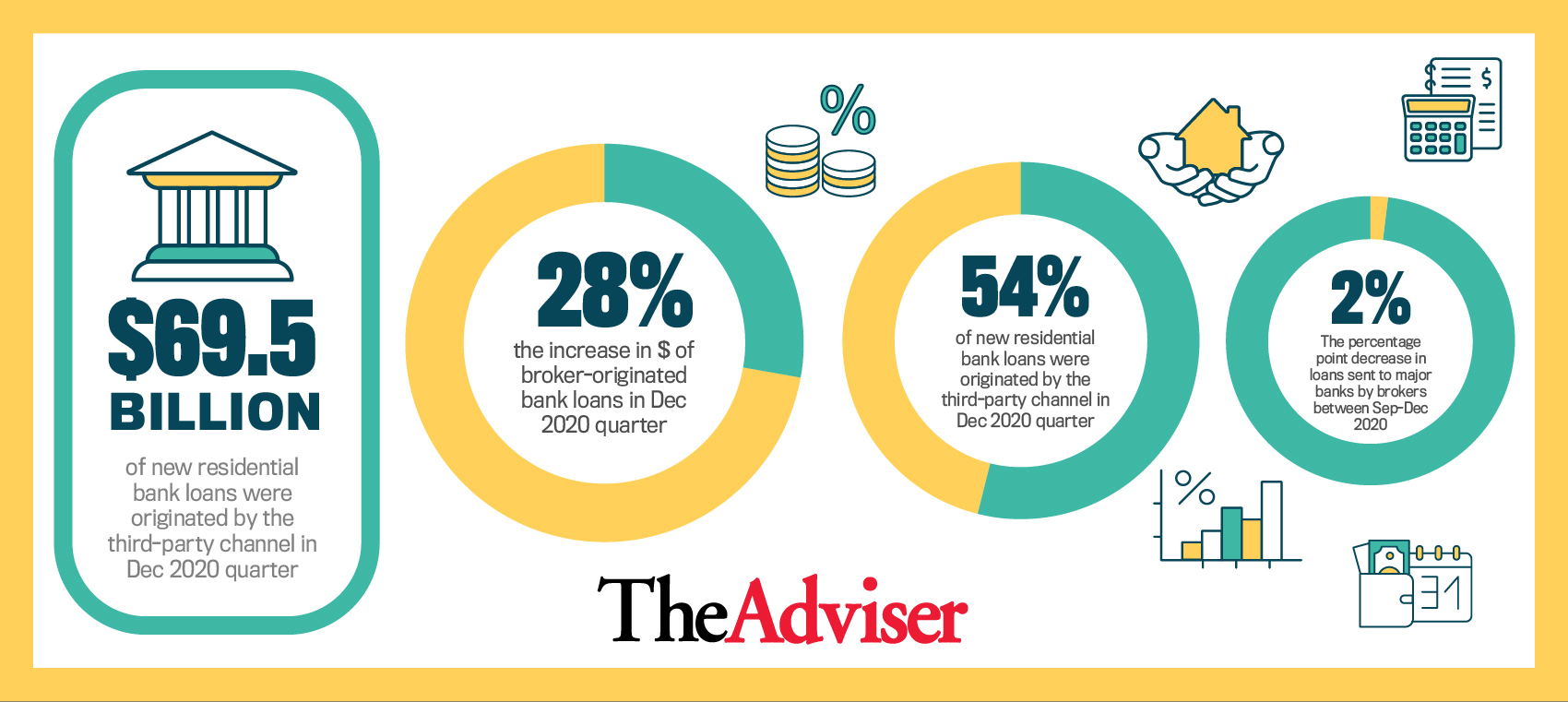

The third-party channel wrote $69.5 billion of new bank loans in the three months ending 2020, up 28 per cent on the prior comparative period (when the channel wrote $54.3 billion).

Indeed, the channel wrote the largest volume of new bank loans in the December 2020 quarter than in any period previously recorded. This surpasses the previous record, $62.8 billion, which was set in the previous three months (ending September 2020).

When extrapolated out over all new bank loans funded (comprising both owner-occupied and investor loans), the third-party channel originated 54 per cent of all new bank loans that quarter.

The APRA stats also show that third-party originated loans account for 52 per cent of all term loans outstanding at the banks, totalling just under $1 trillion ($950 billion).

The banking statistics echo those released by the Mortgage & Finance Association of Australia (MFAA) earlier this month, which show that mortgage brokers recorded their highest ever market share for the December 2020 quarter, settling 59.4 per cent of all residential home loans between October and December 2020.

Third-party continues to drive non-major volumes

Breaking down the ADIs by segment, the APRA data shows that the third-party channel continues to be a major source of flow for non-major banks (‘other domestic banks’ excluding customer-owned banks and building societies).

In the final quarter of 2020, the third-party channel accounted for 67.5 per cent of all new loans funded by the domestic non-majors (excluding customer-owned banks and building societies), originating $16.9 billion of the $25 billion new loans funded that quarter. This reflects a similar proportion originated in the previous quarter (ending September 2020).

Overall, third-party originated loans account for 61 per cent ($177 billion) of all ‘other domestic bank’ term loans outstanding.

The APRA data also shows that the third-party channel originated $869 million (32 per cent) of the $2.6 billion of new loans funded by credit unions and building societies in the quarter ending December 2020. Generally, the third-party channel accounts for 32 per cent of term loans outstanding at building societies and credit unions, according to APRA.

Mutual banks also fare well from third-party origination, with just under a third of new loans ($2.4 billion) funded coming from the channel. This marked the largest volume (in dollar terms) of new loans written by the channel on record.

The third-party originated loans now account for 27.4 per cent of all mutual bank term loans outstanding.

Third-party sending lower volumes to big four banks

Of new term loans funded by the major banks (ANZ, CBA, NAB and Westpac) over the December quarter last year, the third-party channel originated 50 per cent ($47.4 billion of $94.0 billion). While this was up from 45 per cent in the December 2019 quarter, it was down from 52 per cent in the previous quarter (September 2020).

The channel accounts for just under half ($698 billion) of the $1.42 trillion of all credit outstanding at the majors.

[Related: Broker channel at new high for December quarter]