ASIC has revealed that it will only be reviewing remuneration arrangements associated with the sale of residential mortgage products as it prepares its findings for the government.

The corporate watchdog commenced a review at the request of the government to examine the mortgage broking market and determine the effect of current remuneration structures on the quality of consumer outcomes.

“The government has requested that the review be completed by the end of 2016,” the regulator said in an update.

“The government will consider the findings as a first step prior to any potential change in remuneration structures for the mortgage broking industry,” it said.

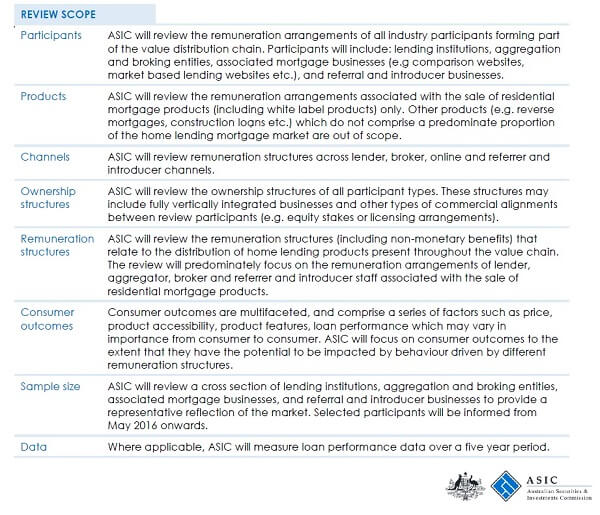

ASIC has now finalised the scope of the review, which can be found in the table below.

The scope sets out the review parameters and is intended to be read in conjunction with the scoping considerations detailed in the 'Review of Mortgage Broker Remuneration Structures: Scoping Discussion Paper February 2016', according to ASIC.

Its provisions have been informed by input received from industry and consumer representatives at industry roundtables and through subsequent written feedback.

ASIC noted that review parameters may shift during the review if the regulator considers this to be appropriate, necessary or in the public interest.

“ASIC may also consider out-of-scope items, or matters arising from this review, separately in the future,” the regulator said.

NAB this week welcomed ASIC’s announcement of the final scope of its review into the broking industry.

“We believe ASIC’s scope is appropriate and we look forward to continuing to work with the regulator throughout the review,” NAB executive general manager for broker partnerships, Anthony Waldron, said.

“We’re dedicated to working with brokers to deliver a great customer experience and we believe this review will help continue to build trust and confidence in the mortgage broking industry,” he said.

[Related: eChoice flags 'very real danger' of commission changes]