Brokers “walk on water” with Valiant’s new platform achieving impressive outcomes for brokers and clients alike. Here’s what recent users say about it

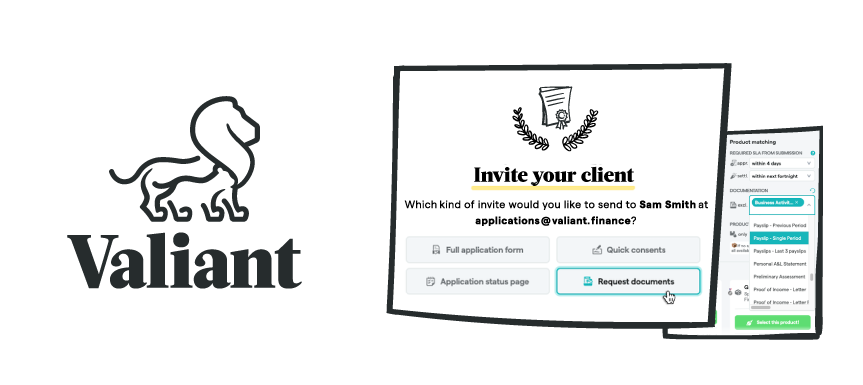

Savanna is changing the way brokers interact with their clients, allowing them to settle more deals while offering additional value.

The platform was developed by business loan marketplace, Valiant Finance, to simplify the transaction process and put an end to frustrating back-and-forth conversations with lenders.

Valiant is backed by ANZ, Westpac and Salesforce and has teamed up with over 80 Australian lenders to offer businesses fast access to funding and brokers premium product matching capabilities.

What brokers are looking for

In Valiant’s recent survey, brokers were asked questions about their experience with clients, tech, lenders and everything in between.

When asked about the challenges associated with their role, brokers said that the admin involved in settling transactions was the bane of their existence. Processing times, bank SLAs, demanding customers and stress levels were also noted as concerns.

Is Savanna the solution?

Hundreds of brokers have already made the switch to Savanna, where they can filter products according to specific SLAs, document exclusions and other client needs.

Savanna also offers brokers the flexibility to manage deals 100% on their own, or delegate tedious admin to an industry-leading support team.

Brokers love how much time and stress this saves them, and have commented on “outstanding” turnaround times, quick solutions and most importantly, great customer feedback.

One newly accredited Savanna user, Bulelwa Freer, says her client now thinks she “walks on water”.

“As a sole business operator, it is a fact that time is not my friend,” said Freer.

“It is equally true that I miss most opportunities due to the fact that I spread myself too thin. When I approached Valiant recently, I was not prepared for the sheer brilliance that the team handles deals with.

The loan was approved within 48 hours, and [this] could have been shorter if the client had not omitted crucial information. Even with that glitch, settlement took place within 72 hours.

[My] client now thinks we walk on water as he had been trying to achieve this outcome for two years and being given all the reasons why he couldn’t!”

How Savanna can help you win clients and boost transactions

Savanna optimises and simplifies the transaction process for existing business finance brokers while also providing a new path for brokers to enter the business finance space and expand their offering (regardless of current credentials).

This is made possible with Valiant’s market-leading product matching technology (ProductIQ), extensive lending panel and dedicated support team, accessible to every Savanna user.

When you sign up to Savanna, you’ll automatically become accredited in business finance broking and connect with a Valiant BDM who will become your main point of contact for enquiries and product information.

Within minutes you can start offering clients business finance, and you’ll receive 70% commission on every successful transaction.

ProductIQ’s 95%+ approval rate is a testament to Valiant’s real time updates (made daily to the platform) and speaks to both the quality of their products and accuracy of their quoting tools.

No more chasing up lenders and clients for information, forms and documents. With ProductIQ, that’s a thing of the past.

If you’d like to sign up or learn more about Savanna, Valiant is currently offering a free demonstration of the platform. Follow the link below to book yours in and a Valiant BDM will be in contact with you to answer any of your questions and walk you through the platform.

Brokers who have signed up to Savanna are already pocketing an average of $2100 per deal.