SMEs are bouncing back and there’s plenty of opportunity for brokers who understand the needs of customers looking for investment.

Despite the challenges of recovering from the COVID-19 pandemic, natural disasters and the flow-on effects of Russia’s invasion of Ukraine on the world economy; the good news is that many small business owners in Australia are looking to invest in their future. However, for the broker community it’s important to take the time to really understand why and how the needs of SME customers are shifting.

Signs of recovery

At BOQ we’re seeing positive signs of recovery with almost 75 per cent of our SME customers having higher cash deposit balances than pre-pandemic levels.

Although most SMEs are in good financial shape, there are discrepancies between sectors and across state borders, largely due to the impact of COVID-19 lockdowns. The sectors hardest hit by government regulations and cautionary spending by consumers – notably hospitality, recreation, some transport sectors and smaller retailers, particularly in CBD locations – are still doing it tough and have tight budgets as a consequence.

Unfortunately, just as these sectors were starting to bounce back, the recent large-scale flooding in parts of NSW and Queensland have added to an already challenging trading environment for many SMEs.

With the property sector performing strongly on account of low interest rates and primary producers doing well due to favourable market conditions, we’re seeing that these sectors are likely to have higher leverage than the SME average.

Adapting to change

Small business owners are generally struggling with three main issues – state government regulation, staff retention and access to materials. And of course, for businesses in those sectors doing it tough, there is the added mental stress of recouping loses after months of lockdown closures and an uncertain outlook in terms of customer demand.

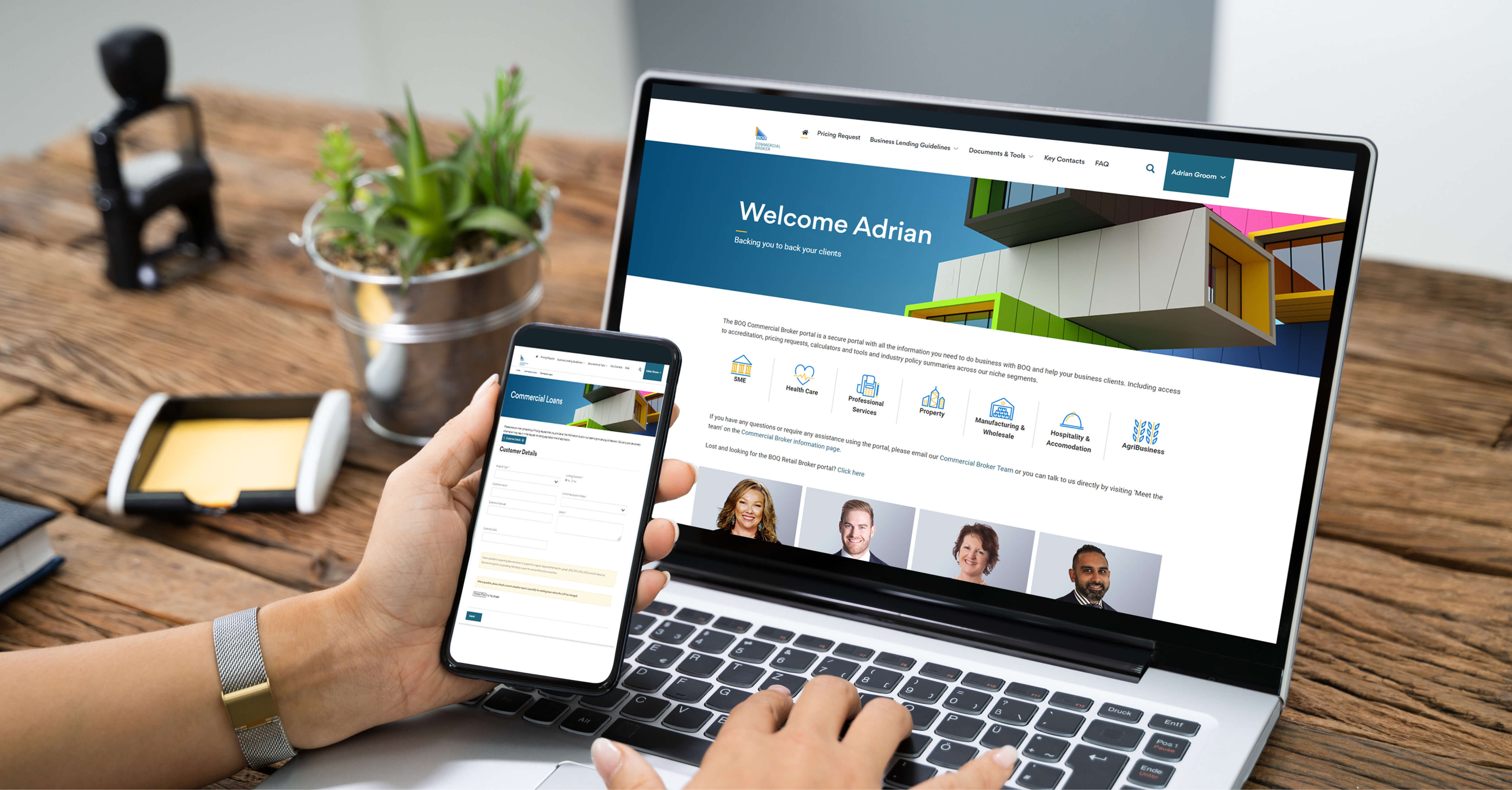

With these challenges, many businesses have been forced to look for ways to adapt – and technology has become an enabler of innovation and opportunity for many SMEs who are recognising the benefits of digitisation. For example, the fast-tracked digitisation of previously manual processes has made internal processes more efficient and the necessity to create platforms that enable access to interactive documents for employees working from home has seen an uplift in productivity. As a service provider it is imperative brokers keep instep with these businesses and not be left behind. BOQ Commercial Broker itself launched an online portal in November 2021, complete with guidelines on niche industries, pricing tool and checklists, so our accredited brokers could self-service, and better understand and deliver solutions to SME clients sooner.

While businesses continue to adapt, access to finance has never been more crucial and BOQ has responded with SME policy changes that create more breadth and flexibility in lending. To help improve cash flow with less cash needed up front, for Commercial loans of up to $3 million we can offer eligible clients*;

- Up to 30 year loan terms and 90% LVR for residential security

- Up to 30 year loan terms and 85% LVR for commercial security; and

- Up to 10 year Interest Only terms.

For more information about how BOQ can back you as a broker to back your SME clients, visit www.boq.com.au/commercialbroker.

Source: BOQ internal data. Only businesses with business deposit accounts since pre-pandemic included.

*For Small and Medium Enterprise (SME) with a Total Business Related Exposure (TBRE) of less than $3m and Total Aggregate Exposure (TAE) of less than $10m. SME, security type and loan purpose eligibility criteria applies (‘SME eligibility criteria’). A maximum Loan-to-Value ratio (LVR) of 85% and the 10 year interest only option applies to owner occupied commercial security, otherwise the maximum LVR is 80% and the maximum interest only period is 5 years. Where the SME eligibility criteria is not met the maximum Loan-to-Value ratio is 70% (non-residential and mixed security) or 80% (residential security), and the maximum loan term is 15 years (non-residential and mixed security) or 25 years (residential security). Applies to the Business Term Loan product only. Not available on Self-Managed Super Fund (SMSF) loans.