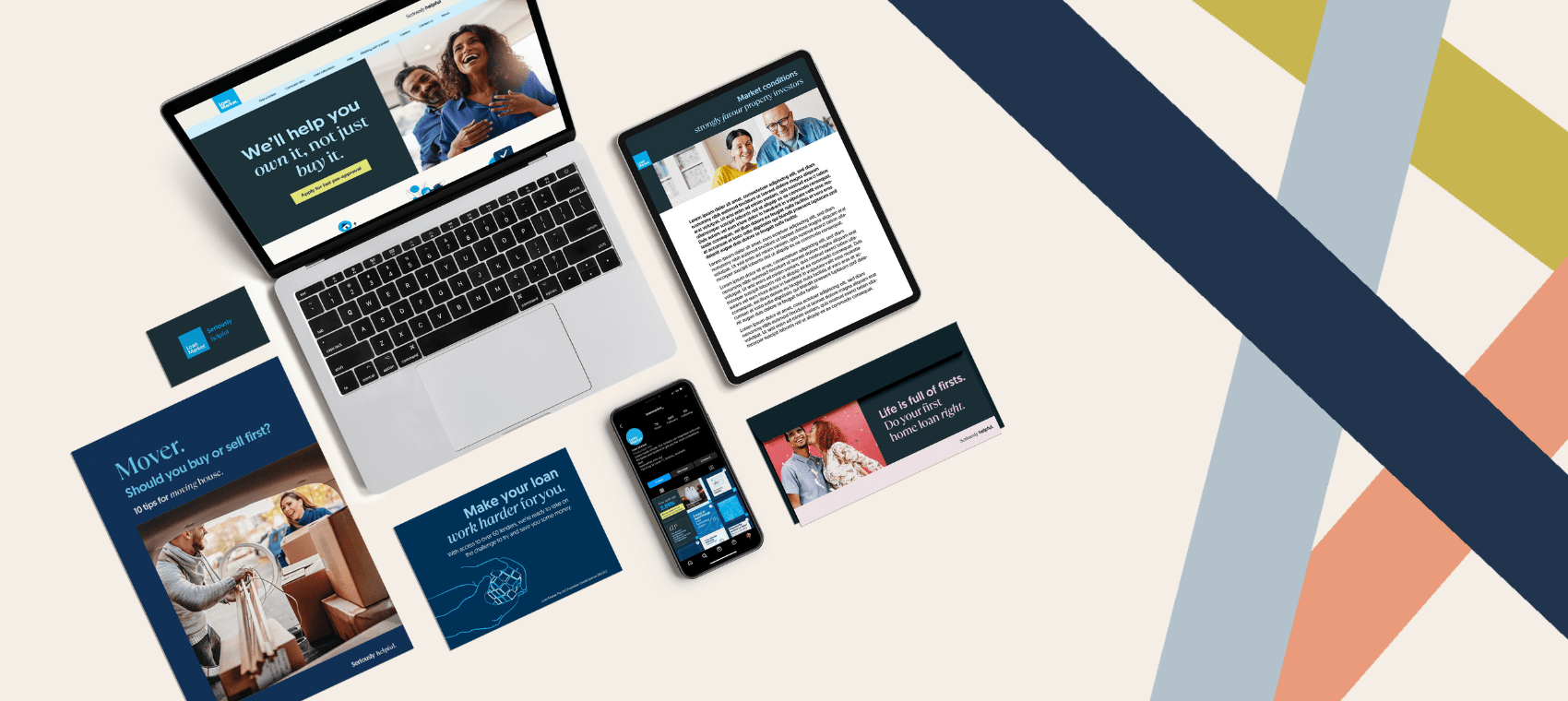

LMG’s suite of marketing solutions helps brokers cut through the noise in the digital marketplace, allowing them to maximise their productivity at the same time.

It’s becoming harder and harder for brokers to stand-out to prospective clients in the marketplace - cutting-through the wall of digital noise while still delivering an exceptional experience to existing customers.

The LMG Partner and Loan Market service plans promise to help brokers find and keep more clients through standout online visibility. The suite of marketing tools provided allow brokers to build their profiles, promote their Unique Service Proposition and generate leads. Importantly, the portfolio of solutions has a strong focus on automation, allowing businesses to remain focused on the immediate tasks at hand and broader growth strategy while their pipeline of new work builds in the background.

My Lead Generator

My Lead Generator is a powerful link that brokers can embed in any digital outreach - their social media, emails, EDMs etc - that directs clients to fill out an Online Fact Find and start their finance journey with the broker.

My Lead Generator not only delivers quality leads to brokers through the two-step verification but also allows this to happen seamlessly and without contact until the broker is presented with the right information.

There’s no double handling of information and, most importantly, not a shred of paper shared.

Short-form video

The use of short-form video continues to accelerate in response to time-poor consumers and shortened attention spans.

The average watch time on Facebook is less than 10 seconds. But the actual time it takes for consumers to decide whether your content is worth their interest, is much, much shorter.

Authenticity and originality are critical to cutting through the digital noise with ‘thumb-stopping’ video content, and that’s where LMG’s Broker Reel solution steps in.

Broker Reel includes:

- script writing for the broker / business;

- 6 fully edited videos (music, captions, colour grading, intro/outros, name straps and audio treatment).

The end-to-end service includes a promotion package:

- creation of a YouTube channel (and videos uploaded with NAP information for SEO purposes);

- all videos loaded to brokers’ Google Business Profile;

- creation of a bespoke paid social media campaign (that can be run through our social media promotion tool, Amplify).

Email and SMS marketing

True digital brokers segment their databases for different personas: First Home Buyers, investors, upgraders and refinancers. These different clients should receive different messaging and insights to keep them engaged and convert as clients.

LMG has designed automated communication solutions for brokers so relationships with prospective and post-settlement clients remain strong.

Nurture, embedded within MyCRM, maintains the relationship between brokers and clients who aren’t ready to proceed to application. Automated communications are sent on a fortnightly basis featuring content that is relevant to their persona. The streams also keep pre-approved applicants who haven’t found the right property close to the broker via buying tips, property reports and other useful information to make an informed purchase.

Once a borrower has settled, Stay in Touch sends a series of automated communications from the broker to client at key points in their financial journey, such as when their fixed-rate period is set to expire. The email series facilitates opportunities for the client to connect with the broker, ensuring they remain a client for life.

LMG also produces three newsletters every month for brokers to share with clients keeping them up to date with topical and evergreen content that affects them as borrowers, saving brokers on average 3 hours of time each month.

Helping clients make informed buying decisions

Once a client is pre-approved, brokers have access to PriceFinder data to prepare suburb reports that are relevant to where the customer is looking to buy. Customers have a wealth of data available to them, but a simple to read, suburb-specific overview that outlines what the market is paying for comparable properties is important in helping clients make informed decisions on their property journey.

Local Search Engine Optimisation (SEO)

Approximately 60% of Google’s ranking signals come from listings that are accurate (Name, Address and Phone Number) and verified.

LMG has partnered with Chatmeter, a citation management solution, to get brokers ranked on page 1 of Google. Chatmeter distributes accurate information across directories and review platforms to improve local search visibility and secure that elusive “top spot” on Google.

After 12 months of using Chatmeter, brokers can expect to see up to 70% increase in Google search visibility and 30% increase in website clicks.

Google Reviews

LMG has automated the process of sourcing online feedback from satisfied customers so they can stay focused on servicing existing and new clients.

The overwhelming majority of consumers won’t contact a business until they’ve researched what others have had to say about them, online. By increasing the number of positive reviews on LMG’s Google My Business page, LMG is boosting the online visibility of its brokers, building-up social proof which gives customers the confidence to choose them as their broker.

Social media advertising

Social Post is a complete hands-free solution for broker social media management. Social Post audits and optimises brokers’ social pages and publishes 14 content-rich posts per month, plus adhoc agile posts like RBA Rate announcements. It saves brokers about 5.5 hours per month.

Amplify is a cost-effective solution for building a broker's brand profile. It auto-creates, optimises and measures social media ads, saving brokers around 30 minutes per ad and ensuring ROI on ad spend is optimised.

If you’re looking for marketing and lead generation solutions that cut through the digital noise, reach out to LMG today to find out how it's helping its brokers stand out from the crowd.