Rising costs and falling consumer demand are biting businesses as B2B invoice values drop 36 per cent, according to new data.

The August 2023 CreditorWatch Business Risk Index has revealed that Australian business activity is at near-record lows as organisations are hurting due to the impact of inflation and consumers struggle with the rising cost of living.

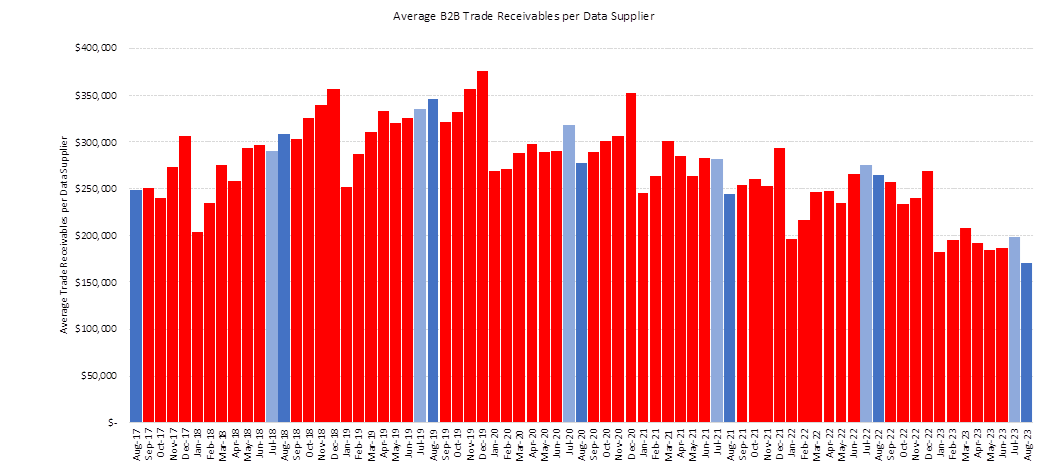

According to the data, businesses are ordering less than ever before, with the average value of business-to-business invoices down 36 per cent year on year, its lowest point since January 2017.

For example, average trade receivables are usually well over $200,000 per month, but this dropped to around $$170,133 in August 2023 – down from $265,300 in August 2022.

Data source: CreditorWatch trade receivables data (accounting software integration)

The drop in invoice values has been exacerbated by an increase in the number of business-to-business trade payment defaults, a “leading indicator of future business failure”.

According to the credit reporting agency, trade payment defaults rose 30 per cent between August 2022 and August 2023.

CreditorWatch chief economist Anneke Thompson stated that the trade payments default index revealed businesses have continued to lodge defaults against their debtors at record rates.

She said: “As the average size of invoices falls, it stands to reason that cash flow is also reducing among a growing cohort of businesses, and this is resulting in more late payment of invoices.

“Unfortunately, this has a snowball effect, as businesses that are being paid late are also at risk of becoming late payers themselves. The past few months’ worth of data tells us that this is already happening.”

However, CreditorWatch found that credit inquiries had risen 65 per cent year on year, but were trending down, in a reflection of the overall slowing of business activity.

Business failure forecasts worsen

The credit reporting agency has also forecast that conditions are not expected to get better, as consumers will need to continue to save large proportions of their income to put towards interest payments or rents until at least the middle of 2024, which will result in less money being spent in the economy overall.

Given the pullback in discretionary spending, CreditorWatch has suggested that this would mean “the business failure rate is only going to get higher, particularly in those areas with heavily leveraged households or those that pay high rents relative to their incomes”.

According to the group, external administrations rose 28 per cent year on year, the highest point since October 2015, with most industries experiencing an increase as they moved off COVID-19 support payments.

Chief executive officer at CreditorWatch Patrick Coghlan commented: “I’m very sorry to say that we’re far from the peak of business failures”.

“Twelve rate rises in just over a year was always going to have a major effect on consumer sentiment and force people to tighten their belts, having a particularly big impact on those businesses exposed to discretionary spending.”

Ms Thompson noted that while monetary policy tightening had worked to slow spending and lower inflation, it had also increased the possibility of business failure.

CreditorWatch now expects the national business failure rate for the next 12 months to rise from 4.54 per cent to 5.76 per cent.

Ms Thompson stated: “The unfortunate reality is that this will also result in business failures, particularly for those businesses that were only marginally profitable when interest rate settings were low.”

Default and insolvency forecast

According to the August 2023 CreditorWatch Business Risk Index, the industries with the highest probability of default over the next 12 months are:

- Food and beverage services - 6.96 per cent

- Transport, postal and warehousing - 4.48 per cent

- Arts and recreation services - 4.42 per cent

The high-cost nature of running food and beverage businesses, along with the slowing demand due to decreasing discretionary spending is particularly hurting the industry.

The sector is also the most at risk of payment defaults at 7 per cent, which is considerably ahead of the next-most exposed industry, transport, postal and warehousing at 4.5 per cent, according to CreditorWatch.

Merrylands-Guildford (NSW), Canterbury (NSW) and Bankstown (NSW) were found to be the regions that would have the greatest default rates in the next 12 months. Meanwhile, Norwood-Payneham-St Peters (SA), Ballarat (VIC) and Unley (SA) had the lowest expected default rates for the upcoming 12 months.

[Related: Tough operating conditions to persist for Aussie businesses]