The ASX has announced that the broking group is no longer on the official list.

ASX Limited has confirmed that Yellow Brick Road Holdings Limited (YBR) has been removed from the official list as of the close of trading yesterday (Monday, 27 November) at the request of YBR.

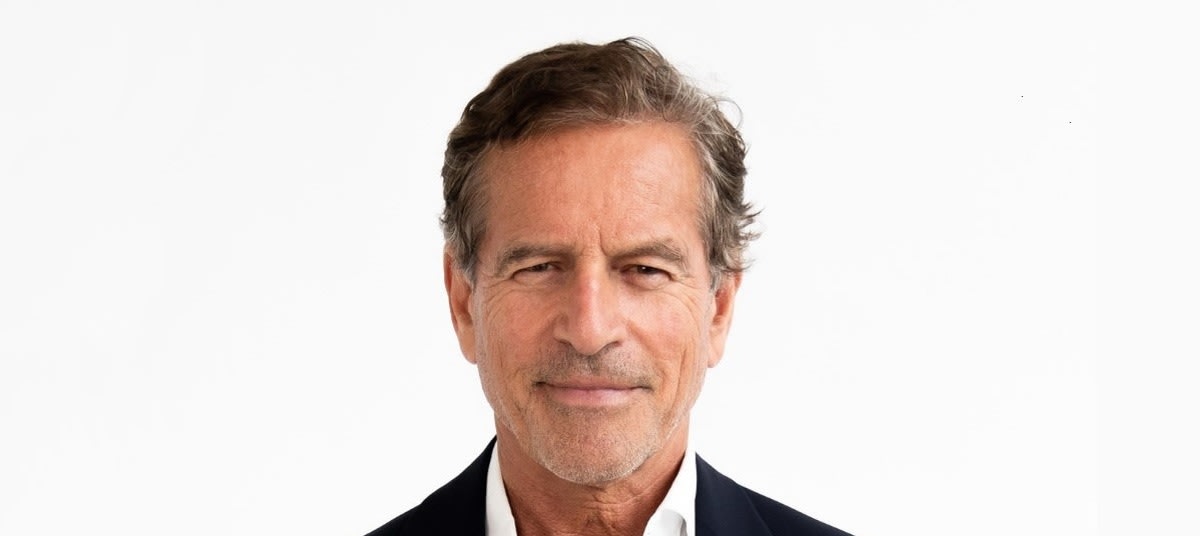

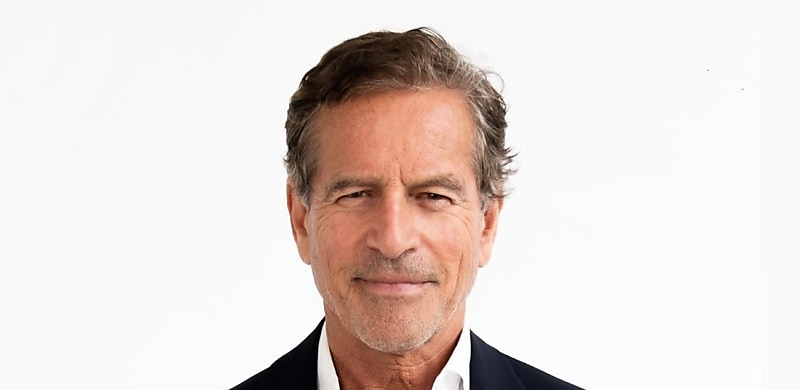

Executive chairman and founder Mark Bouris announced that the board made the “strategic decision” to make the mortgage broking group a private company again on 18 September for the first time in 15 years.

YBR was publicly listed since 2008, but halted trading on the ASX on 14 September as it revealed that it was submitting an application to be removed from the official list.

The board’s statement read that it considered the delisting to be “in the best interests of the company and its shareholders”.

Mr Bouris explained that the decision to be removed from the official list came as the board believed that its trading price did not reflect its underlying value and is an impediment to the brokerage raising capital.

Speaking to The Adviser in September, Mr Bouris said the decision was also made to ensure that the group could “be strategic” by embracing opportunities in the current market while saving money on ASX-related administrative and reporting costs.

The company estimated that it would save approximately $350,000 per annum in expenses by delisting its 326 million shares.

“This does not affect our business in any way. It doesn’t slow our business, it doesn’t speed our business up,” Mr Bouris said.

“There’s no negative outcomes in relation to this. Nothing’s changed.”

He added that being a private company may also make the business more attractive to other businesses.

A drop in settlements

YBR’s most recent financial results revealed a decline of 7.2 per cent from the record $21.4 billion in the financial year 2022 to $19.9 billion in FY23 as a result of the recent weakening in new mortgage demand across Australia.

The Australian Bureau of Statistics (ABS) reported that the value of new loan commitments dropped by around 20 per cent in FY23, while the number of owner-occupier first home buyer loans fell 12 per cent.

However, YBR’s FY23 settlement result still reflected a 48 per cent increase over its FY21 result of $13.4 billion, despite the decline.

YBR’s chief financial officer Stephen McKenzie told The Adviser at the time that the broking group would shift its focus towards growing broker numbers and leverage the group’s recent investments.

[RELATED: ‘The real game isn’t being on the ASX’: Mark Bouris]