Promoted by

![]()

DirectMoney (ASX: DM1) has recently established a large institutional funding arrangement to support its market-leading, 100% online, personal loan product offering designed to be distributed by brokers.

DirectMoney is a pioneer in the Australian financial technology (fintech) space and throughout 2015 and 2016 established a highly popular, personal loan product for distribution via its brokers. DirectMoney’s relationships with aggregators such as McMillan Shakespeare, Finsure, Loan Market, AFG, Smartline and numerous others allows accredited brokers to offer their clients attractively priced, easy to apply, personal loans while retaining 100% control of the client relationship.

Newly appointed Chief Executive Officer, Anthony Nantes, said, “DirectMoney is fully committed to helping brokers grow their businesses. We do this by giving them quick, simple and easy access to the best personal loan product in the market and providing a fantastic customer experience along the way. This is a very competitive market and we understand clearly that our broker’s success is our success”

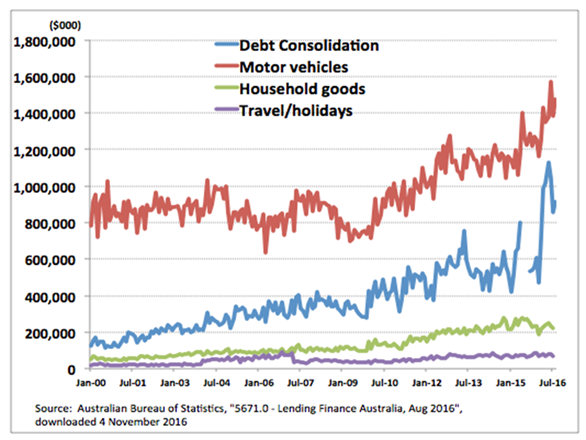

Mr. Nantes continued, “Marketplace lending has seen exponential global growth in the last decade and in Australia it is expected that $1billiion of personal loans will be written by peer to peer and marketplace lenders within the next 2 years. This institutional funding arrangement will support DirectMoney’s goal to become one of Australia’s major marketplace lenders, taking an increasingly larger piece of the A$90 billion consumer finance market”

During FY 2016 DirectMoney wrote $11.2 million in unsecured personal loans of which 85% were for debt consolidation, housing or vehicle finance purposes. DirectMoney’s accredited brokers wrote approximately 50% of these loans.

Figure 1: Australian personal lending by loan purpose

For more information and product specifications, please visit https://www.directmoney.com.au/Partner/