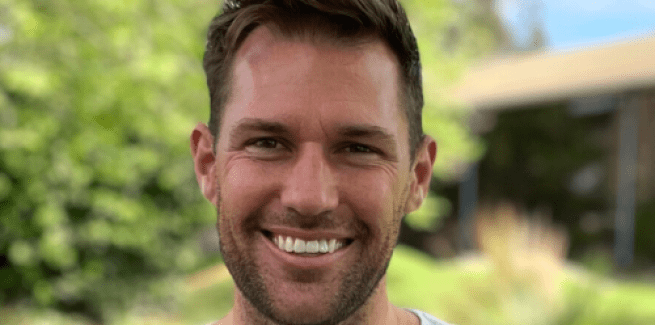

As borrowers rely on their brokers for guidance through these turbulent times, Sherlok founder and CEO Adam Grocke highlights why brokers are a lender’s biggest retention ally – and warns lenders to stop biting the hands that feed them.

Interest rates are rising yet again and brokers are losing sleep trying to keep up with skyrocketing demand for refinancing – and we haven’t even seen the worst of it yet. We’ll hit the peak around late 2023 as ultra low fixed rates start to mature with interest rate hikes.

Panicked borrowers losing their ‘basement rate’ loans are leaning on their brokers as they scramble to move their mortgage somewhere else before their lender’s revert variable hits the monthly budget. These borrowers are driving the second mass wave of refinancing.

But let’s face it – there’s no reason for a borrower to leave their existing lender.

The number one reason borrowers leave is when there's a more competitive rate on offer that their lender refuses to match.

Borrowers are learning to shop around for cheaper rates using digital platforms that are getting better at converting loan shoppers, even though they’d actually be better off using a broker.

I started Sherlok because I was sick of lenders offering better rates for new customers, while my existing clients who had been loyal for many years had to endure higher rates. In fact, the ACCC home loan price inquiry proved that the longer you're with the same lender, the higher your interest rate will be. Borrowers are becoming increasingly aware of this and are turning to their trusted brokers for guidance.

If lenders don’t see brokers as a life raft now, they’ll be the ones drowning in this second refinancing wave. The majority of loans are written through the big four banks and guess what? It was these banks who had access to cheap capital to offer ultra low fixed rates during COVID-19.

Brokers are the most valuable piece of the lender retention puzzle, but I’m not convinced all lenders get it.

If brokers are writing 70 per cent of deals in the nation, brokers can assist 70 per cent of borrowers to stay in their current product with their current lender. Borrowers don’t want the headache of changing lenders, but brokers can only do so much to keep them if lenders keep playing retention games by removing digital retention tools and switching discharge processes to phone.

I've seen brokers’ clients on hold to a lender multiple times for over two hours to request a discharge when this used to be a simple form. Come on.

We've collected repricing data from tens of thousands of loans across Australia. One of the most encouraging insights suggests that lenders don't need to match the lowest rate in the market, but it does need to be fair and competitive. Charging 0.7 per cent to 1.67 per cent above new customer rates just doesn’t cut it in the new digital world.

We need a mindset shift across the industry. Why pay over $15,000 (including cashbacks) to acquire a new client at a very low rate with a low margin when you can spend $0 to keep an existing client? Just reprice them at a competitive rate and keep them for another five years on a loan with a larger margin than a new to bank customer loan.

I take my hat off to lenders out there who are leading a pro-broker strategy free from channel conflict. Lenders that are still encouraging channel conflict and competing with brokers need to look at the opportunity of brokers as the key to a successful retention strategy over the next five years.

Brokers will work hard to keep their clients, which also keeps that client with the lender for longer. In my view, brokers are an underutilised asset that lenders can work with to significantly extend the lifetime of loans by repricing borrowers at more competitive rates.

That's a win for the borrower, broker AND lender.

Adam Grocke is a former mortgage broker that launched customer retention software Sherlok in 2021.