Productivity is an average measure of the efficiency of production. It can be expressed as the ratio of output to inputs used in the production process.

This is how Wikipedia defines productivity, the question is does this have any application to the real world and your business as a finance broker. The answer is a resounding YES and yet it is one of the least used yet most powerful drivers of business success.

Why is this? Simply put, it is invisible, you won’t find it on any of your financial statements, your accountant won’t provide any metrics (unless requested) or reports and it is not something you can touch and feel. However, it exists and is around you all day every day. Business owners who have found the keys and unlocked the value have thriving, productive, efficient and valuable businesses. They are market leaders and have created a culture which others seek to copy.

It can’t be purchased, it can only be created and is unique to your business model. As a business owner the challenge is to know where to look, to identify the drivers of business success, and to establish a system that allows you to monitor progress and to dynamically manage to extract the best outcome. Put simply, productivity drives profit and value. Let us first apply our own (financial) definition and then look at an example.

Productivity is how we use our resources to drive sales, profit and cash flow. As an example, all businesses strive to make as much sales revenue as possible. This is a noble objective and a sound foundation. Sales and selling comes naturally to many business owners, what we want to do though is encourage owners to plan their sales and especially the sales activity. To do so it is simply a case of following a four step process, as follows:

STEP 1: Set your sales revenue goal; how much do you need (want) in sales turnover for the next 12 months to achieve your growth expectations and deliver your profit goals? To arrive at this target it is important to consider business and environmental factors, including what it is happening competitively, what is the economic outlook and what influence this may have.

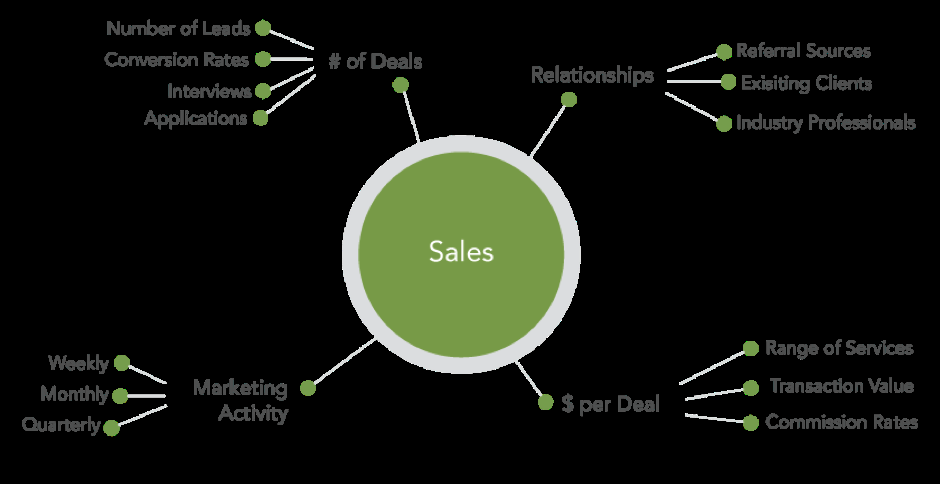

STEP 2: Determine your sales drivers: It is important to recognise you can’t manage sales but you can manage sales drivers. In other words, what are the inputs or the activities that influence sales. The illustration below is a great starting point. It is a simple brainstorming map that can be worked through with your teams as part of the planning process. It is an excellent tool that can be adapted to suit your business.

For example, let us assume you have a business that is strong on referrals. If this is a strength can we explore what else we can do to improve the number of sources and referrals, and assuming we can improve our lead generation, and we are good at converting, what would be the financial impact if we can increase the average deal size? As you can see there is an interconnectivity to this that allows you to prioritise where you should focus and build strategies to achieve the desired outcomes.

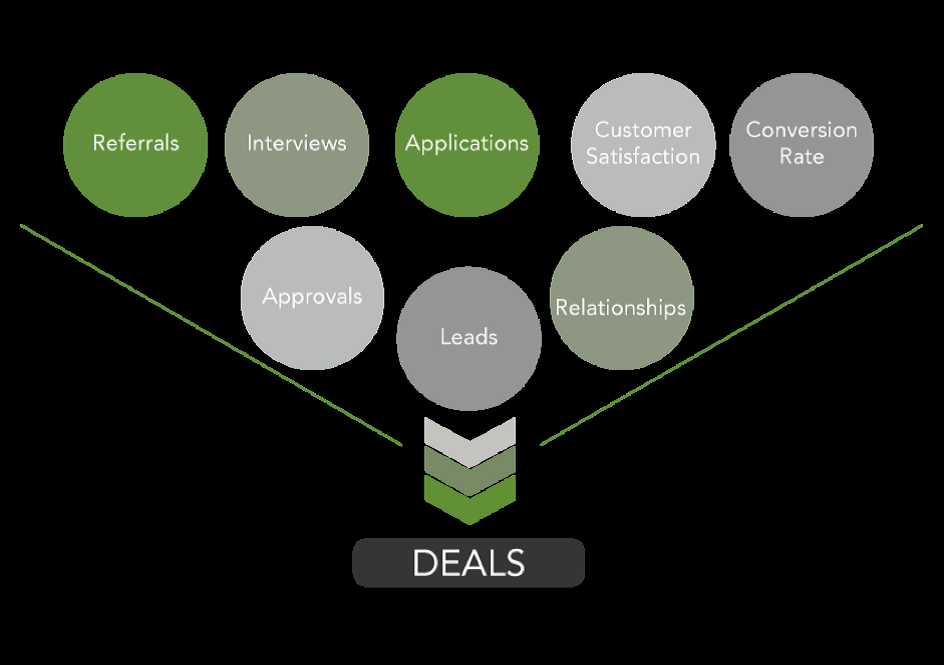

STEP 3: Select your key performance indicators: Having identified the sales drivers and where you want to focus, the next logical step is to identify the metrics that need to be managed and measured dynamically to deliver the best outcome. This includes setting up a system that gives you a read at any point in time as to how you are tracking and enables you to modify or change your approach. It can double as an excellent early warning mechanism.

STEP 4: Execute and monitor key metrics: It is now down to executing the strategy and monitoring the results. This is a short-term (12 months) target that provides a sound basis for measuring and managing the behaviours of your team and those activities that drive the results. What are the productivity measures most appropriate for your business, how will you (can you) hard wire them into your model, is there potential to build a reward scheme around them to provide even greater incentive and is it working? These are all questions that will test your thinking and influence your own behaviour and actions.

Productivity should not be invisible and doesn’t need to be as we have illustrated. Whether you measure your drivers on a whiteboard or build excel spreadsheets is a matter for the individual, the important thing to remember is what gets measured gets done. If you follow this process and execute well, the impact on the financial performance of the business will be profound.